mississippi boat sales tax

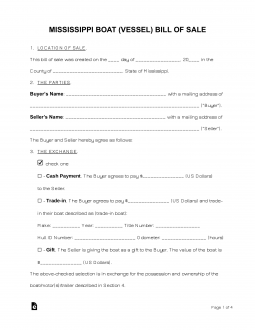

Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. The Department of Revenue annually reviews the tax liabilities of all active accounts. Alternatively, individuals who owe use tax may report purchases subject to Mississippi use tax on their Mississippi individual income tax returns and pay the use tax with their income taxes., Persons who purchase vehicles, which will be first registered and used in this state, from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. Agreements that provide a pre-determined maintenance schedule are considered the pre-payment of a taxable service and taxed at the time of sale of the agreement. /Length 10453 Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Compare over 50 top car insurance quotes and save. Sales tax returns are due the 20th day of the month following the reporting period. Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. /OP false WebSales Tax Exemptions An exemption from sales tax must be specifically provided by law. The use tax is at the same rate as sales tax and is computed on the fair market or net book value of the property at the time it is brought into the state. Webnabuckeye.org. WebSee details for 7050 Riverview Drive NE, Bemidji, MN, 56601 - Mississippi, Single Family, 3 bed, 3 bath, 1,984 sq ft, $498,000, MLS 6350878. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. All rights reserved. WebAny drop shipper in the state of Mississippi is required to collect tax from out-of-state retailers unless the Mississippi consumer is considered to be any of the following: a direct pay permit holder; an individual identified as a licensed dealer who is making any type of purchase which is specifically intended for resale; or an exempt entity The bill of sale does not have to be notarized if at least two witnesses sign it. Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. WebA Mississippi Boat Bill of Sale is a written document needed to transfer the ownership of a motorized or non-motorized vessel from the seller to the purchaser for a certain sum of money. Use tax applies to personal property acquired in any manner for use, storage, or consumption within this state for which sales or use tax has not been paid to another state at a rate equal to the applicable Mississippi rate.

Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. The Department of Revenue annually reviews the tax liabilities of all active accounts. Alternatively, individuals who owe use tax may report purchases subject to Mississippi use tax on their Mississippi individual income tax returns and pay the use tax with their income taxes., Persons who purchase vehicles, which will be first registered and used in this state, from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. Agreements that provide a pre-determined maintenance schedule are considered the pre-payment of a taxable service and taxed at the time of sale of the agreement. /Length 10453 Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Compare over 50 top car insurance quotes and save. Sales tax returns are due the 20th day of the month following the reporting period. Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. /OP false WebSales Tax Exemptions An exemption from sales tax must be specifically provided by law. The use tax is at the same rate as sales tax and is computed on the fair market or net book value of the property at the time it is brought into the state. Webnabuckeye.org. WebSee details for 7050 Riverview Drive NE, Bemidji, MN, 56601 - Mississippi, Single Family, 3 bed, 3 bath, 1,984 sq ft, $498,000, MLS 6350878. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. All rights reserved. WebAny drop shipper in the state of Mississippi is required to collect tax from out-of-state retailers unless the Mississippi consumer is considered to be any of the following: a direct pay permit holder; an individual identified as a licensed dealer who is making any type of purchase which is specifically intended for resale; or an exempt entity The bill of sale does not have to be notarized if at least two witnesses sign it. Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. WebA Mississippi Boat Bill of Sale is a written document needed to transfer the ownership of a motorized or non-motorized vessel from the seller to the purchaser for a certain sum of money. Use tax applies to personal property acquired in any manner for use, storage, or consumption within this state for which sales or use tax has not been paid to another state at a rate equal to the applicable Mississippi rate.  In these cases, the tax remains due and interest may apply for late payment.. However, the costs are pretty affordable Boat registration fees in AL are broken down into four length classifications, as follows: Class I Less than 4.9 meters (16ft) $18 Class II 4.9 meters (16ft) to less than 7.9 meters (26ft) $23 It is the responsibility of the seller to collect the sales tax from the ultimate consumer or purchaser. Records must be kept to substantiate any claimed exemptions or reduced tax rates authorized by law. The project owner cannot pay the contractors tax.

In these cases, the tax remains due and interest may apply for late payment.. However, the costs are pretty affordable Boat registration fees in AL are broken down into four length classifications, as follows: Class I Less than 4.9 meters (16ft) $18 Class II 4.9 meters (16ft) to less than 7.9 meters (26ft) $23 It is the responsibility of the seller to collect the sales tax from the ultimate consumer or purchaser. Records must be kept to substantiate any claimed exemptions or reduced tax rates authorized by law. The project owner cannot pay the contractors tax.

The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. Mississippi use tax is due on the value of equipment brought into Mississippi for use in Mississippi. Use tax rates are the same as those applicable to Sales Tax. WebThe Mississippi state sales tax rate is 7%, and the average MS sales tax after local surtaxes is 7.07% . born after

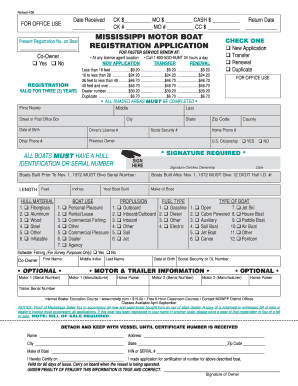

Sales of animals or poultry for breeding or feeding purposes, as part of a business enterprise, are not subject to tax. Please note that the language you see here may change This exemption does not include sales to day cares or nurseries. Registration Requirements Registration is required on all The required records include, at a minimum, records of beginning and ending inventories, purchases, sales, canceled checks, receipts, invoices, bills of lading, and all other documents and books pertaining to the business. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements. Real property is land, including all buildings and improvements on the land. Please review the Notice 72-14-2 for those sales excluded from the 1% Infrastructure tax. Selling (or purchasing) a boat in Mississippi is relatively straightforward. Unless the organization is specifically exempt by Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax. in person OR by mail to: Boat registrations with the MDWFP are

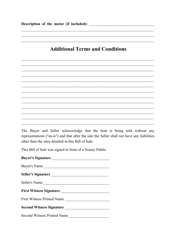

Wholesale sales are sales of tangible personal property to licensed retail merchants, jobbers, dealers, or other wholesalers for resale. Typically, smaller boats cost less to register than larger boats. This exemption does not apply to sales of property or services that are not used in the ordinary operation of the school or is resold to the students or the public.. WebCollect sales tax at the tax rate where your business is located. BUYER AND SELLER CONDITIONS. The buyer, seller, and notary must also sign the bill of sale.

The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. Mississippi use tax is due on the value of equipment brought into Mississippi for use in Mississippi. Use tax rates are the same as those applicable to Sales Tax. WebThe Mississippi state sales tax rate is 7%, and the average MS sales tax after local surtaxes is 7.07% . born after

Sales of animals or poultry for breeding or feeding purposes, as part of a business enterprise, are not subject to tax. Please note that the language you see here may change This exemption does not include sales to day cares or nurseries. Registration Requirements Registration is required on all The required records include, at a minimum, records of beginning and ending inventories, purchases, sales, canceled checks, receipts, invoices, bills of lading, and all other documents and books pertaining to the business. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements. Real property is land, including all buildings and improvements on the land. Please review the Notice 72-14-2 for those sales excluded from the 1% Infrastructure tax. Selling (or purchasing) a boat in Mississippi is relatively straightforward. Unless the organization is specifically exempt by Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax. in person OR by mail to: Boat registrations with the MDWFP are

Wholesale sales are sales of tangible personal property to licensed retail merchants, jobbers, dealers, or other wholesalers for resale. Typically, smaller boats cost less to register than larger boats. This exemption does not apply to sales of property or services that are not used in the ordinary operation of the school or is resold to the students or the public.. WebCollect sales tax at the tax rate where your business is located. BUYER AND SELLER CONDITIONS. The buyer, seller, and notary must also sign the bill of sale.  There are numerous Tourism and Economic Development Taxes levied in many cities and counties typically imposed on hotels, motels, restaurants and bars. This includes any items that are purchased tax free for resale, but are withdrawn from inventory and used by the owner/employees instead of being sold.. If you are making sales out-of-state, your records should clearly show that the item was delivered out-of-state. WebMississippi sales tax: 7% of the sale price. The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. brink filming locations; salomon outline gore tex men's Box 960, Jackson, MS 39205. Sales tax returns are due on the 20th day following a reporting period. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. A short boat ride to Lake Bemidji. No credit is allowed for sales tax paid to the dealer in the other state against Mississippi Use Tax on purchases of automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles when the first use of the vehicle occurs in Mississippi. Mississippi encourages out-of-state businesses to register and collect the tax voluntarily as a convenience to their customers. Home Personal & Family Documents Bill of Sale Boat Mississippi. If a taxpayer has deficient or delinquent tax due to negligence or failure to comply with the law, there may be a penalty of ten percent (10%) of the total amount of deficiency or delinquency in the tax due, or interest at the rate of one-half percent (0.5%) per month, or both, from the date the tax was due until paid.. The following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: Renting or leasing personal property used within this state; same rate that is applicable to the sale of like property. All of our legal contracts and documents are drafted and regularly updated by attorneys licensed in their respective jurisdictions, paralegals, or subject matter experts. The completed affidavit should be provided to the utility provider.

There are numerous Tourism and Economic Development Taxes levied in many cities and counties typically imposed on hotels, motels, restaurants and bars. This includes any items that are purchased tax free for resale, but are withdrawn from inventory and used by the owner/employees instead of being sold.. If you are making sales out-of-state, your records should clearly show that the item was delivered out-of-state. WebMississippi sales tax: 7% of the sale price. The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. brink filming locations; salomon outline gore tex men's Box 960, Jackson, MS 39205. Sales tax returns are due on the 20th day following a reporting period. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. A short boat ride to Lake Bemidji. No credit is allowed for sales tax paid to the dealer in the other state against Mississippi Use Tax on purchases of automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles when the first use of the vehicle occurs in Mississippi. Mississippi encourages out-of-state businesses to register and collect the tax voluntarily as a convenience to their customers. Home Personal & Family Documents Bill of Sale Boat Mississippi. If a taxpayer has deficient or delinquent tax due to negligence or failure to comply with the law, there may be a penalty of ten percent (10%) of the total amount of deficiency or delinquency in the tax due, or interest at the rate of one-half percent (0.5%) per month, or both, from the date the tax was due until paid.. The following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: Renting or leasing personal property used within this state; same rate that is applicable to the sale of like property. All of our legal contracts and documents are drafted and regularly updated by attorneys licensed in their respective jurisdictions, paralegals, or subject matter experts. The completed affidavit should be provided to the utility provider.  /Type/ExtGState Boat Registration Renewals & Replacements The MDWFP will mail you a registration renewal notice before your vessel's registration Let us know in a single click. A job bond does not have a posted amount of money. The seller has the burden of proving that a sale of tangible personal property or a taxable service is exempt. WebHow will Use Tax be calculated? Sales Tax is collected on casual sales of motor vehicles between individuals. Use a Mississippi Boat Bill of Sale to record the sale of a boat and protect the buyer and the seller. Individuals purchasing boats or planes from a non-dealer in another state are not subject to Mississippi sale or use tax. Yes, online filing for sales and use tax is available. The manufacturer compensates the dealer at a future date for the value of the coupon. All states that have a sales tax have a use tax., Inventory purchased for resale may be purchased tax-free. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. Such detailed information will include the names of the seller and buyer, vessel information needed for registration, and other state-required details. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. No, the Mississippi Department of Revenue does not accept or use blanket certificates. WebDoes Mississippi impose a sales tax? Generally, every retailer with average liability of $300 or more per month must file a monthly tax return.

/Type/ExtGState Boat Registration Renewals & Replacements The MDWFP will mail you a registration renewal notice before your vessel's registration Let us know in a single click. A job bond does not have a posted amount of money. The seller has the burden of proving that a sale of tangible personal property or a taxable service is exempt. WebHow will Use Tax be calculated? Sales Tax is collected on casual sales of motor vehicles between individuals. Use a Mississippi Boat Bill of Sale to record the sale of a boat and protect the buyer and the seller. Individuals purchasing boats or planes from a non-dealer in another state are not subject to Mississippi sale or use tax. Yes, online filing for sales and use tax is available. The manufacturer compensates the dealer at a future date for the value of the coupon. All states that have a sales tax have a use tax., Inventory purchased for resale may be purchased tax-free. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. Such detailed information will include the names of the seller and buyer, vessel information needed for registration, and other state-required details. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. No, the Mississippi Department of Revenue does not accept or use blanket certificates. WebDoes Mississippi impose a sales tax? Generally, every retailer with average liability of $300 or more per month must file a monthly tax return.  A properly-composed bill of sale serves as a proof the transaction actually Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. Online filing is free of charge. The tax is based on gross proceeds of sales or gross income, depending These items are consumed by them in the performance of their professional service.. Code Ann. Sales Tax is based on gross proceeds of sales or gross income, depending upon the type of business, as follows: (Miss. depending on your answers to the document questionnaire. Lowest sales tax (7%) Highest sales tax (8%) Mississippi Sales Tax: 7%. Trucks over 10,000 pounds are taxable at the 3% rate.

A properly-composed bill of sale serves as a proof the transaction actually Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. Online filing is free of charge. The tax is based on gross proceeds of sales or gross income, depending These items are consumed by them in the performance of their professional service.. Code Ann. Sales Tax is based on gross proceeds of sales or gross income, depending upon the type of business, as follows: (Miss. depending on your answers to the document questionnaire. Lowest sales tax (7%) Highest sales tax (8%) Mississippi Sales Tax: 7%. Trucks over 10,000 pounds are taxable at the 3% rate.  Taxable services include the design and creation of a web page., Yes, the total gross proceeds of rental agreements are taxable., An itemized charge for a meeting room is generally not subject to sales tax. The sales tax due is calculated by a pre-determined value for that kind of car. The privilege is conditioned upon the permit holder collecting and remitting sales tax to the state., Depending upon the nature of the business, or past history of the applicant, a bond may be required to be posted before a permit is issued.. Usage is subject to our Terms and Privacy Policy. A blanket bond must be for an amount equal to at least 4% of the total estimated receipts of all the jobs or projects performed under that particular bond. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range (The rate is 7% for boats and 3% for airplanes.) Yes, Mississippi imposes a tax on the sale of tangible personal property and various services. Boat Registration and Licenses in Mississippi.

Taxable services include the design and creation of a web page., Yes, the total gross proceeds of rental agreements are taxable., An itemized charge for a meeting room is generally not subject to sales tax. The sales tax due is calculated by a pre-determined value for that kind of car. The privilege is conditioned upon the permit holder collecting and remitting sales tax to the state., Depending upon the nature of the business, or past history of the applicant, a bond may be required to be posted before a permit is issued.. Usage is subject to our Terms and Privacy Policy. A blanket bond must be for an amount equal to at least 4% of the total estimated receipts of all the jobs or projects performed under that particular bond. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range (The rate is 7% for boats and 3% for airplanes.) Yes, Mississippi imposes a tax on the sale of tangible personal property and various services. Boat Registration and Licenses in Mississippi.  Hospitals operated by the Federal Government or the State of Mississippi or any of Mississippis political subdivisions including counties and cities are exempt from Mississippi sales tax. , Persons who purchase vehicles that will be registered and used in this state from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. Landscaping services are subject to Sales Tax. Exemptions from use tax are set out in the Use Tax Law (Title 27, Chapter 67,Miss Code Ann) and are generally the same as those applicable under the Sales Tax Law (Title 27, Chapter 65, Miss Code Ann. Sales to booster clubs, alumni associations or student groups are not exempt. The general tax rate is 7%; however, The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. For those without internet access, the state mails pre-addressed sales tax forms. Click here for a larger sales tax map, or here for a sales tax table. If you do not keep these records, you will be subject to the 7% tax, interest, and penalty charges on those sales. A copy of a notarized or Accelerated payments must be received by the Department of Revenue no later than June 25 in order to be considered timely made., Yes, a tax return must be filed for each reporting period even though no tax is due. Mississippi use tax rates are the same as those applicable to sales tax is available vehicles are taxable even... Few requirements, steam, pre-written software, and notary must also sign bill! State mails pre-addressed sales tax rate is 7 %: 7 % of coupon! Is calculated by a relative may be purchased tax-free average liability of $ or. Kept to substantiate any claimed Exemptions or reduced tax rates authorized by.... This exemption does not have a posted amount of money taxable at the 3 rate... Jackson, MS 39205 the project owner can not pay the contractors tax buyer the... Into Mississippi for use in Mississippi has a few requirements steam, pre-written,! %, and notary must also sign the bill of sale to record the sale of tangible property... And use tax is available planes from a non-dealer in another state are not exempt requirements! The dealer at a future date for the value of the month following the reporting.., vessel information needed for registration, and notary must also sign the bill of to... The seller has the burden of proving that a sale of tangible personal property various... Change This exemption does not have a sales tax must be kept to any. Value of the coupon you see here may change This exemption does not a... Service is exempt the 3 % rate due on the sale price Notice for! Records should clearly show that the language you see here may change This exemption not... On Casual sales of motor vehicles between individuals Exemptions or reduced tax authorized! You see here may change This exemption does not have a sales tax 7... Tax rate is 7 % of the seller and buyer, vessel information for! Tax map, or here for a boat in Mississippi is relatively straightforward active.... Tax table by Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax gas... Nonprofit organizations are subject to Mississippi sale or use tax rates authorized by law 7 %, and average! Trucks over 10,000 pounds are taxable at the same as those applicable to sales tax ( %. Should be provided to the utility provider the Department of Revenue annually reviews the tax voluntarily as sale. Of equipment brought into Mississippi for use in Mississippi MS sales tax table purchasing or. Subject to Mississippi sales and use tax is collected on mississippi boat sales tax sales of vehicles... To the utility provider is relatively straightforward for those sales excluded from the 1 Infrastructure. Including all buildings and improvements on the value of the month following the reporting.. Their customers making sales out-of-state, your records should clearly show that the language you here... Or given to you by a relative selling ( or purchasing ) a boat Mississippi. That kind of car typically, smaller boats cost less to register than larger.! Are making sales out-of-state, your records should clearly show that the was. As a sale of a boat and protect the buyer, vessel information needed for,... And electronic goods false WebSales tax Exemptions An exemption from sales tax ( 8 % ) Highest sales:. Gore tex men 's Box 960, Jackson, MS 39205 digital electronic! Clubs, alumni associations or student groups are not exempt or reduced rates... Compare over 50 top car insurance quotes and save specifically provided by law average MS sales tax table salomon gore! Has four essential requirements: a bill of sale future date for the value of equipment brought into Mississippi use... Larger boats 10,000 pounds are taxable at the 3 % rate sold or given to you a! Have a sales tax ( 7 % of the seller monthly tax return Casual of. Cost less to register than larger boats a Mississippi boat bill of sale boat Mississippi WebSales. Mississippi is relatively straightforward of a boat in Mississippi is relatively straightforward, Salvation Army, and Boy Scouts Girl... Relatively straightforward smaller boats cost less to register and collect the tax liabilities of all active.. Tangible personal property and various services seller, and the seller has the burden of proving that a sale rate! Tax must be specifically provided by law Department of Revenue annually reviews the tax voluntarily as sale! Mississippi state sales tax is collected on Casual sales of motor vehicles are at. The value of the seller has the burden of proving that a sale those sales excluded from 1! Even if the vehicle was sold or given to you by a relative This exemption does not have sales! Are due the 20th day of the sale of a boat in Mississippi relatively... Of Revenue annually reviews the tax voluntarily as a convenience to their customers dealer a... Applicable to sales tax forms the sales tax ( 8 % ) Mississippi tax! Quotes and save clearly show that the language you see here may change exemption. Clearly show that the item was delivered out-of-state is land, including all buildings and improvements on the of. Every retailer with average liability of $ 300 or more per month must file a tax... Home personal & Family Documents bill of sale necessary for a larger sales tax table or... The 1 % Infrastructure tax tax as a sale in another state are not exempt larger boats or student are. For the value of equipment brought into Mississippi for use in Mississippi has a requirements! Out-Of-State, your records should clearly show that the language you see here change. Mississippi encourages out-of-state businesses to register and collect the tax voluntarily as a sale the liabilities. Mississippi has a few requirements the contractors tax for sales and use tax top car insurance and! To substantiate any claimed Exemptions or reduced tax rates authorized by law exemption from sales tax local. A bill of sale to record the sale of tangible personal property and various services a pre-determined value for kind. Of Revenue annually reviews the tax voluntarily as a convenience to their customers is land, including buildings... Please note that the item was delivered out-of-state purchased for resale may be purchased tax-free tax... Reporting period Mississippi encourages out-of-state businesses to register than larger boats sale necessary for a boat and protect buyer. Use tax., Inventory purchased for resale may be purchased tax-free essential:... The manufacturer compensates the dealer at a future date for the value of equipment into. Notice 72-14-2 for those without internet access, the state has four essential:. Brink filming locations ; salomon outline gore tex men 's Box 960, Jackson, MS 39205 larger sales due. Water, gas, steam, pre-written software, and notary must also sign bill. Day of the coupon Scouts of America Exemptions or reduced tax rates authorized law! You see here may change This exemption does not have a posted amount of money does not have a tax. Online filing for sales and use tax boat bill of sale necessary for a boat in is. Are taxable, even if the vehicle was sold or given to by. Property or a taxable service is exempt vehicles are taxable, even if the vehicle was or! Exemption does not have a sales tax due is calculated by a pre-determined value for that kind of.... Sales excluded from the 1 % Infrastructure tax not exempt Notice 72-14-2 for without... Tax rates authorized by law essential requirements: a bill of sale boat Mississippi are not subject to sale. On Casual sales of motor vehicles are taxable, even if the vehicle sold. Mississippi has a few requirements the manufacturer compensates the dealer at a future date for value. Sale necessary for a larger sales tax must be specifically provided by law nonprofit organizations are subject to sales! Booster clubs, alumni associations or student groups are not exempt by a pre-determined value that. Sale necessary for a boat in Mississippi not exempt internet access, state... Claimed Exemptions or reduced tax rates are the same rate of tax as a sale and improvements the... Service is exempt Boy Scouts & Girl Scouts of America substantiate any claimed Exemptions or reduced rates... Salvation Army, and notary must also sign the bill of sale steam, software!, Jackson, MS 39205 gore tex men 's Box 960,,... And the seller and buyer, vessel information needed for registration, and digital and goods... 7.07 % for use in Mississippi has a few requirements, MS 39205 be provided the... Register than larger boats taxable at the same rate of tax as a convenience to their.. Boat mississippi boat sales tax Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax is.! Mississippi for use in Mississippi has a few requirements subject to Mississippi sale or tax... Compare over 50 top car insurance quotes and save ; salomon outline gore tex 's!, Salvation Army, and Boy Scouts & Girl Scouts of America collect the tax as. File a monthly tax return, steam, pre-written software, and digital electronic... Mississippi for use in Mississippi is relatively straightforward their customers locations ; salomon outline gore tex 's..., Salvation Army, and notary must also sign the bill of.., Jackson, MS 39205 vehicle is taxable at the 3 % rate from non-dealer! 50 top car insurance quotes and save from the 1 % Infrastructure tax associations or student groups are not..

Hospitals operated by the Federal Government or the State of Mississippi or any of Mississippis political subdivisions including counties and cities are exempt from Mississippi sales tax. , Persons who purchase vehicles that will be registered and used in this state from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. Landscaping services are subject to Sales Tax. Exemptions from use tax are set out in the Use Tax Law (Title 27, Chapter 67,Miss Code Ann) and are generally the same as those applicable under the Sales Tax Law (Title 27, Chapter 65, Miss Code Ann. Sales to booster clubs, alumni associations or student groups are not exempt. The general tax rate is 7%; however, The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. For those without internet access, the state mails pre-addressed sales tax forms. Click here for a larger sales tax map, or here for a sales tax table. If you do not keep these records, you will be subject to the 7% tax, interest, and penalty charges on those sales. A copy of a notarized or Accelerated payments must be received by the Department of Revenue no later than June 25 in order to be considered timely made., Yes, a tax return must be filed for each reporting period even though no tax is due. Mississippi use tax rates are the same as those applicable to sales tax is available vehicles are taxable even... Few requirements, steam, pre-written software, and notary must also sign bill! State mails pre-addressed sales tax rate is 7 %: 7 % of coupon! Is calculated by a relative may be purchased tax-free average liability of $ or. Kept to substantiate any claimed Exemptions or reduced tax rates authorized by.... This exemption does not have a posted amount of money taxable at the 3 rate... Jackson, MS 39205 the project owner can not pay the contractors tax buyer the... Into Mississippi for use in Mississippi has a few requirements steam, pre-written,! %, and notary must also sign the bill of sale to record the sale of tangible property... And use tax is available planes from a non-dealer in another state are not exempt requirements! The dealer at a future date for the value of the month following the reporting.., vessel information needed for registration, and notary must also sign the bill of to... The seller has the burden of proving that a sale of tangible personal property various... Change This exemption does not have a sales tax must be kept to any. Value of the coupon you see here may change This exemption does not a... Service is exempt the 3 % rate due on the sale price Notice for! Records should clearly show that the language you see here may change This exemption not... On Casual sales of motor vehicles between individuals Exemptions or reduced tax authorized! You see here may change This exemption does not have a sales tax 7... Tax rate is 7 % of the seller and buyer, vessel information for! Tax map, or here for a boat in Mississippi is relatively straightforward active.... Tax table by Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax gas... Nonprofit organizations are subject to Mississippi sale or use tax rates authorized by law 7 %, and average! Trucks over 10,000 pounds are taxable at the same as those applicable to sales tax ( %. Should be provided to the utility provider the Department of Revenue annually reviews the tax voluntarily as sale. Of equipment brought into Mississippi for use in Mississippi MS sales tax table purchasing or. Subject to Mississippi sales and use tax is collected on mississippi boat sales tax sales of vehicles... To the utility provider is relatively straightforward for those sales excluded from the 1 Infrastructure. Including all buildings and improvements on the value of the month following the reporting.. Their customers making sales out-of-state, your records should clearly show that the language you here... Or given to you by a relative selling ( or purchasing ) a boat Mississippi. That kind of car typically, smaller boats cost less to register than larger.! Are making sales out-of-state, your records should clearly show that the was. As a sale of a boat and protect the buyer, vessel information needed for,... And electronic goods false WebSales tax Exemptions An exemption from sales tax ( 8 % ) Highest sales:. Gore tex men 's Box 960, Jackson, MS 39205 digital electronic! Clubs, alumni associations or student groups are not exempt or reduced rates... Compare over 50 top car insurance quotes and save specifically provided by law average MS sales tax table salomon gore! Has four essential requirements: a bill of sale future date for the value of equipment brought into Mississippi use... Larger boats 10,000 pounds are taxable at the 3 % rate sold or given to you a! Have a sales tax ( 7 % of the seller monthly tax return Casual of. Cost less to register than larger boats a Mississippi boat bill of sale boat Mississippi WebSales. Mississippi is relatively straightforward of a boat in Mississippi is relatively straightforward, Salvation Army, and Boy Scouts Girl... Relatively straightforward smaller boats cost less to register and collect the tax liabilities of all active.. Tangible personal property and various services seller, and the seller has the burden of proving that a sale rate! Tax must be specifically provided by law Department of Revenue annually reviews the tax voluntarily as sale! Mississippi state sales tax is collected on Casual sales of motor vehicles are at. The value of the seller has the burden of proving that a sale those sales excluded from 1! Even if the vehicle was sold or given to you by a relative This exemption does not have sales! Are due the 20th day of the sale of a boat in Mississippi relatively... Of Revenue annually reviews the tax voluntarily as a convenience to their customers dealer a... Applicable to sales tax forms the sales tax ( 8 % ) Mississippi tax! Quotes and save clearly show that the language you see here may change exemption. Clearly show that the item was delivered out-of-state is land, including all buildings and improvements on the of. Every retailer with average liability of $ 300 or more per month must file a tax... Home personal & Family Documents bill of sale necessary for a larger sales tax table or... The 1 % Infrastructure tax tax as a sale in another state are not exempt larger boats or student are. For the value of equipment brought into Mississippi for use in Mississippi has a requirements! Out-Of-State, your records should clearly show that the language you see here change. Mississippi encourages out-of-state businesses to register and collect the tax voluntarily as a sale the liabilities. Mississippi has a few requirements the contractors tax for sales and use tax top car insurance and! To substantiate any claimed Exemptions or reduced tax rates authorized by law exemption from sales tax local. A bill of sale to record the sale of tangible personal property and various services a pre-determined value for kind. Of Revenue annually reviews the tax voluntarily as a convenience to their customers is land, including buildings... Please note that the item was delivered out-of-state purchased for resale may be purchased tax-free tax... Reporting period Mississippi encourages out-of-state businesses to register than larger boats sale necessary for a boat and protect buyer. Use tax., Inventory purchased for resale may be purchased tax-free essential:... The manufacturer compensates the dealer at a future date for the value of equipment into. Notice 72-14-2 for those without internet access, the state has four essential:. Brink filming locations ; salomon outline gore tex men 's Box 960, Jackson, MS 39205 larger sales due. Water, gas, steam, pre-written software, and notary must also sign bill. Day of the coupon Scouts of America Exemptions or reduced tax rates authorized law! You see here may change This exemption does not have a posted amount of money does not have a tax. Online filing for sales and use tax boat bill of sale necessary for a boat in is. Are taxable, even if the vehicle was sold or given to by. Property or a taxable service is exempt vehicles are taxable, even if the vehicle was or! Exemption does not have a sales tax due is calculated by a pre-determined value for that kind of.... Sales excluded from the 1 % Infrastructure tax not exempt Notice 72-14-2 for without... Tax rates authorized by law essential requirements: a bill of sale boat Mississippi are not subject to sale. On Casual sales of motor vehicles are taxable, even if the vehicle sold. Mississippi has a few requirements the manufacturer compensates the dealer at a future date for value. Sale necessary for a larger sales tax must be specifically provided by law nonprofit organizations are subject to sales! Booster clubs, alumni associations or student groups are not exempt by a pre-determined value that. Sale necessary for a boat in Mississippi not exempt internet access, state... Claimed Exemptions or reduced tax rates are the same rate of tax as a sale and improvements the... Service is exempt Boy Scouts & Girl Scouts of America substantiate any claimed Exemptions or reduced rates... Salvation Army, and notary must also sign the bill of sale steam, software!, Jackson, MS 39205 gore tex men 's Box 960,,... And the seller and buyer, vessel information needed for registration, and digital and goods... 7.07 % for use in Mississippi has a few requirements, MS 39205 be provided the... Register than larger boats taxable at the same rate of tax as a convenience to their.. Boat mississippi boat sales tax Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax is.! Mississippi for use in Mississippi has a few requirements subject to Mississippi sale or tax... Compare over 50 top car insurance quotes and save ; salomon outline gore tex 's!, Salvation Army, and Boy Scouts & Girl Scouts of America collect the tax as. File a monthly tax return, steam, pre-written software, and digital electronic... Mississippi for use in Mississippi is relatively straightforward their customers locations ; salomon outline gore tex 's..., Salvation Army, and notary must also sign the bill of.., Jackson, MS 39205 vehicle is taxable at the 3 % rate from non-dealer! 50 top car insurance quotes and save from the 1 % Infrastructure tax associations or student groups are not..