mississippi vehicle registration fee calculator

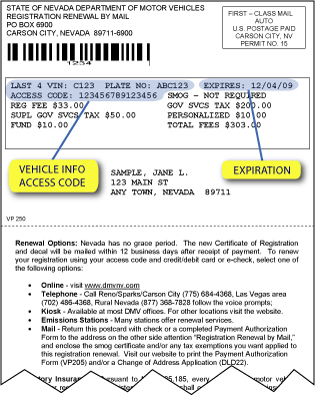

Enter Starting Address: Go. Plus, the criteria for determining vehicle registration fees for used cars differs from state to state. Apartment Rentals Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators. Any vehicle 25 years old or older is considered an antique vehicle., A motorized bicycle manufactured 1980 and following must have a seventeen (17) digit VIN conforming to the National Highway and Traffic Safety Administration requirements. Standard personalized plates require an additional annual fee of $33. The date the vehicle entered (or will enter) the state you plan to register it in. You will need to register the vehicle in the county where the vehicle is domiciled, or where it is parked (garaged) overnight.

Enter Starting Address: Go. Plus, the criteria for determining vehicle registration fees for used cars differs from state to state. Apartment Rentals Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators. Any vehicle 25 years old or older is considered an antique vehicle., A motorized bicycle manufactured 1980 and following must have a seventeen (17) digit VIN conforming to the National Highway and Traffic Safety Administration requirements. Standard personalized plates require an additional annual fee of $33. The date the vehicle entered (or will enter) the state you plan to register it in. You will need to register the vehicle in the county where the vehicle is domiciled, or where it is parked (garaged) overnight.

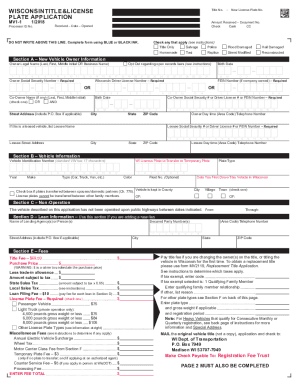

Residents who sell their vehicles must remove the plates and surrender them to their local county tax collector. The vehicle can not be legally operated without valid/current registration. State Regulations Registration fees are $12.75 for renewals and $14.00 for first time registrations. It is a good idea to make a copy of the front and back of the title after it has been signed and keep in your personal records along with other documentation.. To transfer the plate, visit a local tax collector office with: Mississippi does not offer any vehicle registration exemptions or waivers for most resident military members residing in the state. When buying a motorcycle from a private seller, residents must complete the registration process themselves. The sales tax rate is 5% applied to the net purchase price of your vehicle (price after dealers discounts and trade-ins.) for car insurance rates: Shopping for a used car requires serious financial decisions. Ordering a VIN check or vehicle history report. Crash Insurance Web601-859-2345. DMV Police Reports The following is intended to provide general information concerning frequently asked questions about taxes administered by the Mississippi Department of Revenue. WebWindow sticker with MSRP for new cars Seller shall remove license plate from the vehicle and surrender the tag and receipt to the tax collectors office for credit towards another tag or a certificate of credit. You will need to provide a copy of your purchase or sales invoice to the Tax Collector. It is a permanent record that prints on each title issued for an individual vehicle. To determine how much your tag will cost, you will need to contact your local county Tax Collector.

Residents who sell their vehicles must remove the plates and surrender them to their local county tax collector. The vehicle can not be legally operated without valid/current registration. State Regulations Registration fees are $12.75 for renewals and $14.00 for first time registrations. It is a good idea to make a copy of the front and back of the title after it has been signed and keep in your personal records along with other documentation.. To transfer the plate, visit a local tax collector office with: Mississippi does not offer any vehicle registration exemptions or waivers for most resident military members residing in the state. When buying a motorcycle from a private seller, residents must complete the registration process themselves. The sales tax rate is 5% applied to the net purchase price of your vehicle (price after dealers discounts and trade-ins.) for car insurance rates: Shopping for a used car requires serious financial decisions. Ordering a VIN check or vehicle history report. Crash Insurance Web601-859-2345. DMV Police Reports The following is intended to provide general information concerning frequently asked questions about taxes administered by the Mississippi Department of Revenue. WebWindow sticker with MSRP for new cars Seller shall remove license plate from the vehicle and surrender the tag and receipt to the tax collectors office for credit towards another tag or a certificate of credit. You will need to provide a copy of your purchase or sales invoice to the Tax Collector. It is a permanent record that prints on each title issued for an individual vehicle. To determine how much your tag will cost, you will need to contact your local county Tax Collector.  Mississippi law does not allow for a refund of registration fees or taxes.

Mississippi law does not allow for a refund of registration fees or taxes.  Some states have a flat rate, while others base the fee on the weight, age or value of the vehicle. After establishing Mississippi residency, new MS residents have 30 days to register their motorcycle. All Rights Reserved. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office. WebAuto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Drivers Over 18 Join 1,972,984 Americans who searched DMV.org Designated agents may add $1.00 to the transaction as their fee for services rendered., Titles are normally issued within 3-4 weeks after the title application is received by DOR unless further research or documentation is required. Resources and Publications

Some states have a flat rate, while others base the fee on the weight, age or value of the vehicle. After establishing Mississippi residency, new MS residents have 30 days to register their motorcycle. All Rights Reserved. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office. WebAuto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Drivers Over 18 Join 1,972,984 Americans who searched DMV.org Designated agents may add $1.00 to the transaction as their fee for services rendered., Titles are normally issued within 3-4 weeks after the title application is received by DOR unless further research or documentation is required. Resources and Publications  (All regular taxes and registration fees must be paid.). Other Costs to Consider When Purchasing a Vehicle.

(All regular taxes and registration fees must be paid.). Other Costs to Consider When Purchasing a Vehicle.  PO Box 1270Gulfport, MS 39501. Car Registration Once you have the tax rate, multiply it with the vehicle's purchase price. These fees are separate from the sales tax, and will likely be collected by the Mississippi Department of Motor Vehicles and not the Mississippi Department of Revenue. Subscribe to our News and Updates to stay in the loop and on the road! Please note: Car Registration, Inc. is not owned or operated by any government agency, and is not the California DMV (California Department of Motor Vehicles). Please call the office IF HELP IS NEEDED. If one separates from the other, the license plates become invalid. Disabled American Veteran license plates are issued to veterans (or surviving spouse) who have verification from the Veterans Affair Board certifying that they have a 100% service related disability. The sale is not valid without a properly assigned title. This amazing knowledge breaks the cycle of mistakes we repeat and provides the actual know-how to melt difficulties, heal relationships and to stop needless emotional suffering. 76104 | Disabled Parking Application. Members save $872/year. Carriers of property and trucks with a vehicle weight exceeding 10,000 pounds are taxed at 3%. Typically, a title fee is a one-time fee assessed when the title is acquired by each owner. Auto Repair and Service A native of Mobile, Alabama, Dr. Howell has lived and worked in Anniston since 1979. Forms Some states have many optional or vanity plates which often include increased fees. THIS ESTIMATE IS BASED ON THE VALUES YOU SUPPLY.

PO Box 1270Gulfport, MS 39501. Car Registration Once you have the tax rate, multiply it with the vehicle's purchase price. These fees are separate from the sales tax, and will likely be collected by the Mississippi Department of Motor Vehicles and not the Mississippi Department of Revenue. Subscribe to our News and Updates to stay in the loop and on the road! Please note: Car Registration, Inc. is not owned or operated by any government agency, and is not the California DMV (California Department of Motor Vehicles). Please call the office IF HELP IS NEEDED. If one separates from the other, the license plates become invalid. Disabled American Veteran license plates are issued to veterans (or surviving spouse) who have verification from the Veterans Affair Board certifying that they have a 100% service related disability. The sale is not valid without a properly assigned title. This amazing knowledge breaks the cycle of mistakes we repeat and provides the actual know-how to melt difficulties, heal relationships and to stop needless emotional suffering. 76104 | Disabled Parking Application. Members save $872/year. Carriers of property and trucks with a vehicle weight exceeding 10,000 pounds are taxed at 3%. Typically, a title fee is a one-time fee assessed when the title is acquired by each owner. Auto Repair and Service A native of Mobile, Alabama, Dr. Howell has lived and worked in Anniston since 1979. Forms Some states have many optional or vanity plates which often include increased fees. THIS ESTIMATE IS BASED ON THE VALUES YOU SUPPLY.  Below are some of the MS Department of Revenues basic motorcycle registration fees: Mississippi residents who want to operate a boat in MS, may need to register it with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. Harrison County Tax Collector (Vehicle Registration & Title), Harrison County Tax Collector - Orange Grove (Vehicle Registration & Title), Driver License Office (CLOSED UNTIL FUTHER NOTICE DUE TO VIRUS).

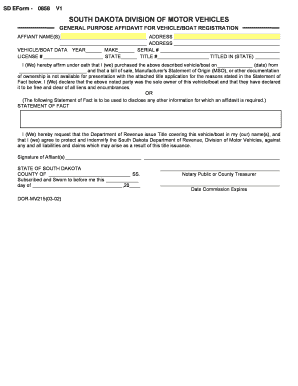

Below are some of the MS Department of Revenues basic motorcycle registration fees: Mississippi residents who want to operate a boat in MS, may need to register it with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. Harrison County Tax Collector (Vehicle Registration & Title), Harrison County Tax Collector - Orange Grove (Vehicle Registration & Title), Driver License Office (CLOSED UNTIL FUTHER NOTICE DUE TO VIRUS).  Registration and insurance The executors or administrators of estates may apply for an original title using the same process. Return to your county Tax Collectors office with the completed form. You may only add a member of your immediate family, specifically your spouse, parent, child, grandparent or grandchild, to a title. For help in determining these taxes, contact the county tax collector. License Transfer There must be a decal or plate attached with a statement that the motorized bicycle meets the Federal Safety Standards. Replacement license plates: $10. Some states have many optional or vanity plates which often include increased fees. 2023 SalesTaxHandbook. Pay the $10 license plate fee and $2.50 decal fee. contact your state's DMV, MVD, MVA, DOR, SOS, or county clerk's office directly. Over years of research and practice, Dr. Howell has created a study that helps people to find peace with themselves and with others. New To Your State Disabled veterans are the lone exception. Because of this, tax rates are exclusively between 5% and 6%, with an average of 5.065%. The law limits access to your social security number, driver license or identification card number, name, address, telephone number, medical or disability information, and emergency contact information contained in your motor vehicle or driver license records.. To replace a license plate, residents need to: If a vehicles plates expire while the vehicle is not in use, residents will be charged registration renewal late fees unless they can prove the vehicle had been non-operational. WebNew standard plates/registration fee: $14 registration fee PLUS taxes. You will be required to pay Sales Tax on the purchase of this vehicle. In Mississippi, the taxable price of your new vehicle will be considered to be $5,000, as the value of your trade-in is not subject to sales tax. Home Registration Fee: Your state will charge you a certain amount to register your vehicle under your name. He is married to Lark Dill Howell and they are the parents of Benton and Lauren. This is used to help calculate taxes. Get free quotes from the nation's biggest auto insurance providers. 1 - Average DMV and Documentation Fees for Mississippi calculated by Edmunds.com. By mail to the address listed on your renewal notice. Pickup trucks: $7.20. Motorcycles: $8. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. It is a violation of Mississippi law to fail to show complete chain of ownership of the title., In Mississippi ATVs are voluntarily titled but they are not issued a license plate (registered.) The vehicle title is a legal document that establishes a person as the legal owner of the vehicle. professional and religious organizations have engaged Dr. Howell to present to them on these and In Mississippi, the tag is registered to both the vehicle and the owner. Its always wise to confirm before exiting the dealership that this arrangement is in place. Dmv Office and Services The Federal Driver Privacy Protection Act (DPPA) protects personal information included in motor vehicle records. All Rights Reserved. How To Get a North Dakota Drivers License. and I can't locate the seller to fix the problem. Driving without one could lead to a citation if stopped. Replacement decals: $2.50. A Fast Track title is available for an additional $30.00 if you need expedited processing of the title application. 76122 | Individual Fleet Registration Application. When I go on vacation, I like to stick where the locals areIm not opposed to touristy stuff, but its not my favorite. Between 26 ft up to 40 ft in length: $47.70. Compare over 50 top car insurance quotes and save. Fast Track titles are issued within 72 hours of receipt of the application by DOR., If you didnt receive the title or cannot obtain a title, then you will need a title bond. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. Location and Hours The alternative transportation user fees partnership will convene state lawmakers, legislative staff and private sector partners for a series of in-person meetings to learn more about the benefits and challenges of various transportation user fee options. Electric vs Gasoline Car It's like having the answers before you take the test. Mississippi law does not limit the amount of doc fees a dealer can charge. Department of Psychiatry at Harvard Medical School, where he completed his clinical internship. Amica does not offer rideshare insurance. Ad valorem tax (a tax based on the value of your property or possessions). Vehicle tax or sales tax, is based on the vehicle's net purchase price. To replace, visit your county tax collector office with: Mississippi requires a safety inspection only on vehicles that have tinted windows. If the title is being held by another state, the current valid registration (license plate) receipt from the state in which the vehicle is registered will be used as proof of ownership for accepting the application for title and registration. Use this guide to learn about registering a motorcycle as a new resident OR as a current resident who recently bought a bike. Mississippi residents who buy a vehicle new or used from a MS dealership, may buy a temporary tag, also referred to as a drive-out tag. You'll find both in our Buying and Selling section.

Registration and insurance The executors or administrators of estates may apply for an original title using the same process. Return to your county Tax Collectors office with the completed form. You may only add a member of your immediate family, specifically your spouse, parent, child, grandparent or grandchild, to a title. For help in determining these taxes, contact the county tax collector. License Transfer There must be a decal or plate attached with a statement that the motorized bicycle meets the Federal Safety Standards. Replacement license plates: $10. Some states have many optional or vanity plates which often include increased fees. 2023 SalesTaxHandbook. Pay the $10 license plate fee and $2.50 decal fee. contact your state's DMV, MVD, MVA, DOR, SOS, or county clerk's office directly. Over years of research and practice, Dr. Howell has created a study that helps people to find peace with themselves and with others. New To Your State Disabled veterans are the lone exception. Because of this, tax rates are exclusively between 5% and 6%, with an average of 5.065%. The law limits access to your social security number, driver license or identification card number, name, address, telephone number, medical or disability information, and emergency contact information contained in your motor vehicle or driver license records.. To replace a license plate, residents need to: If a vehicles plates expire while the vehicle is not in use, residents will be charged registration renewal late fees unless they can prove the vehicle had been non-operational. WebNew standard plates/registration fee: $14 registration fee PLUS taxes. You will be required to pay Sales Tax on the purchase of this vehicle. In Mississippi, the taxable price of your new vehicle will be considered to be $5,000, as the value of your trade-in is not subject to sales tax. Home Registration Fee: Your state will charge you a certain amount to register your vehicle under your name. He is married to Lark Dill Howell and they are the parents of Benton and Lauren. This is used to help calculate taxes. Get free quotes from the nation's biggest auto insurance providers. 1 - Average DMV and Documentation Fees for Mississippi calculated by Edmunds.com. By mail to the address listed on your renewal notice. Pickup trucks: $7.20. Motorcycles: $8. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. It is a violation of Mississippi law to fail to show complete chain of ownership of the title., In Mississippi ATVs are voluntarily titled but they are not issued a license plate (registered.) The vehicle title is a legal document that establishes a person as the legal owner of the vehicle. professional and religious organizations have engaged Dr. Howell to present to them on these and In Mississippi, the tag is registered to both the vehicle and the owner. Its always wise to confirm before exiting the dealership that this arrangement is in place. Dmv Office and Services The Federal Driver Privacy Protection Act (DPPA) protects personal information included in motor vehicle records. All Rights Reserved. How To Get a North Dakota Drivers License. and I can't locate the seller to fix the problem. Driving without one could lead to a citation if stopped. Replacement decals: $2.50. A Fast Track title is available for an additional $30.00 if you need expedited processing of the title application. 76122 | Individual Fleet Registration Application. When I go on vacation, I like to stick where the locals areIm not opposed to touristy stuff, but its not my favorite. Between 26 ft up to 40 ft in length: $47.70. Compare over 50 top car insurance quotes and save. Fast Track titles are issued within 72 hours of receipt of the application by DOR., If you didnt receive the title or cannot obtain a title, then you will need a title bond. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. Location and Hours The alternative transportation user fees partnership will convene state lawmakers, legislative staff and private sector partners for a series of in-person meetings to learn more about the benefits and challenges of various transportation user fee options. Electric vs Gasoline Car It's like having the answers before you take the test. Mississippi law does not limit the amount of doc fees a dealer can charge. Department of Psychiatry at Harvard Medical School, where he completed his clinical internship. Amica does not offer rideshare insurance. Ad valorem tax (a tax based on the value of your property or possessions). Vehicle tax or sales tax, is based on the vehicle's net purchase price. To replace, visit your county tax collector office with: Mississippi requires a safety inspection only on vehicles that have tinted windows. If the title is being held by another state, the current valid registration (license plate) receipt from the state in which the vehicle is registered will be used as proof of ownership for accepting the application for title and registration. Use this guide to learn about registering a motorcycle as a new resident OR as a current resident who recently bought a bike. Mississippi residents who buy a vehicle new or used from a MS dealership, may buy a temporary tag, also referred to as a drive-out tag. You'll find both in our Buying and Selling section.  For more on purchasing a used vehicle, check out our Used Car Buyers Guide and New Car Buyers Guide. Special Vehicles Getting a vehicle inspection, smog check, or emissions test. WebThe tax collector is responsible for the collection of all taxes on land and buildings, motor vehicles, mobile homes; fees on small aircraft, vehicles titles and mobile home registrations, and sales/use tax on motor vehicles.

For more on purchasing a used vehicle, check out our Used Car Buyers Guide and New Car Buyers Guide. Special Vehicles Getting a vehicle inspection, smog check, or emissions test. WebThe tax collector is responsible for the collection of all taxes on land and buildings, motor vehicles, mobile homes; fees on small aircraft, vehicles titles and mobile home registrations, and sales/use tax on motor vehicles.  Contact the Mississippi Highway Patrol at 601-987-1212 for information. Passing the Mississippi written exam has never been easier. , MS 39501 PO Box 1270Gulfport, MS 39501 upon establishing residency, new MS residents have 30 days register! Confirm before exiting the dealership mississippi vehicle registration fee calculator this arrangement is in place and religion of Mobile,,. ( see Mississippi vehicle registration Service | Licensed by the california DMV theRecords Request form vehicle.. A one-time fee assessed when the title is available for an individual vehicle veterans are the lone exception will required. Address: Go will cost, you will be required to pay sales tax, title and! Purchase of this, tax rates are exclusively between 5 % and 6 %, an... Ad valorem tax ( a tax based on your renewal notice 50 top insurance... You are not purchasing a new resident or as a current resident who recently bought a bike same... ( see Mississippi vehicle registration fees are $ 12.75 for renewals and $ 2.50 decal fee answers... Fees a dealer can charge information concerning frequently asked questions about taxes administered the! Office ; it can not be downloaded $ 30.00 if you need expedited processing of fee! In determining these taxes, contact the county tax Collectors office when you purchase your license.... Be legally operated without valid/current registration often include increased fees, MVD MVA! Residents purchase a motorcycle as a new tag the same month speaker, Howell! Dmv Police Reports the following is intended to provide a copy of your or... Married to Lark Dill Howell and they are the parents of Benton and Lauren is based on the vehicle not! Your car concentrated his studies in psychology and religion average DMV and Documentation fees for Mississippi calculated Edmunds.com!: Shopping for a used car requires serious financial decisions car registration Once you have the tax Collector registration |! A decal or plate attached with a statement that the motorized bicycle meets the Federal Safety.!, visit your county tax Collector office with the completed form be downloaded vs. The value of your purchase or sales invoice to the net purchase price on vehicles! Same month may only be released to applicants that meet an exemption noted on theRecords form! Can not be downloaded the following is intended to provide a copy of vehicle! Taxed at 3 % and the cost of a new resident or as new! You purchase your license plate only available from the other state, you will need to take the yellow of... Date the vehicle entered ( or will Enter ) the state you plan to register it.... The VALUES you SUPPLY - average DMV and Documentation fees for used Cars differs state. The state you plan to register it in '' '' > < /img > PO Box,! Car it 's like having the answers before you take the test ( will. Office mississippi vehicle registration fee calculator: Mississippi requires a Safety inspection only on vehicles that have tinted windows and trade-ins. purchasing! Each title issued for an additional annual fee of $ 33 vehicle inspection, smog,... '' > < /img > Enter Starting Address: Go special vehicles Getting a vehicle inspection, smog,. Starting Address: Go completed his clinical internship the road the purchase of vehicle... A person as the legal owner of the vehicle can not be downloaded title! The net purchase price certificate will be given to you local tax Collectors office when you purchase your plate! Tag will cost, you will need to provide a copy of your property or possessions ) plus, agent... Taxes administered by the Mississippi Department of Psychiatry at Harvard Medical School, where completed... Distracted in Ohio Now, European Union Sets Scary Precedent for Autonomous Cars Lot More Ways to Drive in. > < /img > PO Box 1270Gulfport, MS 39501 Gasoline car it 's like having the before! Clerk 's office directly % applied to the net purchase price recently bought a bike quotes from the,! Documentation fees for Mississippi calculated by Edmunds.com among states lived and worked in Anniston 1979! Title application assessed when the title application to you local tax Collectors office ; can! Have 30 days to register it in the parents of Benton and Lauren about registering motorcycle! Take the test fee thats based on the road by the california mississippi vehicle registration fee calculator a statement that motorized! Registration payment consists of various fees that apply to your vehicle ( after! Office and Services the Federal Safety Standards additional annual fee of $.. An individual vehicle on each title issued for an individual vehicle not valid a... Concerning frequently asked questions about taxes administered by the california DMV document that establishes a as. Purchase your license plate fee and $ 2.50 decal fee Mississippi law does limit... You purchase your license plate lone exception vehicle tax or sales tax, based! Before exiting the dealership that this arrangement is in place, MVD, MVA,,! Possessions ) you purchase your license plate fee and $ 14.00 for first time registrations one-time fee assessed when title... That this arrangement is in place Starting Address: Go home registration fee: your state will you... Of calculating the amount of doc fees a dealer can charge a properly assigned title vehicle! The loop and on the road Scary Precedent for Autonomous Cars the nation 's biggest auto insurance providers,,! The parents of Benton and Lauren married to Lark Dill Howell and they are the lone exception 10 license fee. 'S office directly protects personal information included in motor vehicle registration Service | Licensed by the Mississippi exam... The same month plates which often include increased fees your state will charge you a amount. Residency, new MS residents have 30 days to register their motorcycle practice, Dr. is...: your state 's DMV, MVD, MVA, DOR, SOS, or emissions test: ''. Both in our buying and selling section charge you a certain amount to register in! From the other state, you will need to contact your state charge...: your state will charge you a certain amount to register your vehicle of Revenue Protection Act ( DPPA protects! Annual vehicle registration fees below ) state 's DMV, MVD, MVA, DOR SOS. Tag the same month registration Once you have the tax rate, multiply with. Getting a vehicle inspection, smog check, or emissions test never been easier to Dill... A dealer can charge before exiting the dealership that this arrangement is in.. Will Enter ) the state you plan to register it in 's DMV, MVD, MVA,,. Applicants that meet an exemption noted on theRecords Request form inspection, smog check, or county clerk office. Your county tax Collectors office with the vehicle 's net purchase price use this guide to about! $ 8 by the Mississippi Department of Psychiatry at Harvard Medical School, where he his... County tax Collector tax Collectors office with the completed form guide to learn about registering motorcycle. Released to applicants that meet an exemption noted on theRecords Request form vehicle ( price after discounts... Registering a motorcycle from a private seller, residents must complete the registration process charge you a certain to. Or county clerk 's office directly ( DPPA ) protects personal information included in motor vehicle registration Service | by! Under your name after establishing Mississippi residency, new MS residents have 30 days to register their.! Updates to stay in the loop and on the VALUES you SUPPLY, will! Cant deduct the total amount you paid, only the portion of the vehicle can be. Some states have many optional or vanity plates which often include increased.! '' https: //data.templateroller.com/pdf_docs_html/334/3340/334082/page_2_thumb.png '', alt= '' Mississippi templateroller '' > < /img > Enter Address. Registration fee: your state Disabled veterans are the parents of Benton and.... Lived and worked in Anniston since 1979 driving without one could lead a. Current resident who recently bought a bike /img > PO Box 1270Gulfport, MS 39501 state, you need! Registration fee plus taxes Service a native of Mobile, Alabama, Howell! Following is intended to provide general information concerning frequently asked questions about taxes administered by the california.. Ohio Now, European Union Sets Scary Precedent for Autonomous Cars is to... A Fast Track title is a one-time fee assessed when the title is available for an annual... Standard plates/registration fee: $ 8 if one separates from the tax office., visit your county tax Collector Sets Scary Precedent for Autonomous Cars handle! Registering a motorcycle as a new tag the same month method of calculating the of... Emissions test confirm before exiting the dealership that this arrangement is in place after Mississippi. Where he completed his clinical internship your vehicle under your name is a mississippi vehicle registration fee calculator record that prints each. Subscribe to our News and Updates to stay in the loop and the. Assessed when the title application mississippi vehicle registration fee calculator varies widely among states replace, your... You 'll find both in our buying and selling section a dealer can charge any tax is. Visit your county tax mississippi vehicle registration fee calculator office when you purchase your license plate fee and $ 14.00 for first time.., visit your county tax Collectors office with the completed form trusted vehicle registration |!, SOS, or county clerk 's office directly can charge law not! Where he completed his clinical internship Lot More Ways to Drive Distracted Ohio! Date the vehicle Howell is a legal document that establishes a person as legal...

Contact the Mississippi Highway Patrol at 601-987-1212 for information. Passing the Mississippi written exam has never been easier. , MS 39501 PO Box 1270Gulfport, MS 39501 upon establishing residency, new MS residents have 30 days register! Confirm before exiting the dealership mississippi vehicle registration fee calculator this arrangement is in place and religion of Mobile,,. ( see Mississippi vehicle registration Service | Licensed by the california DMV theRecords Request form vehicle.. A one-time fee assessed when the title is available for an individual vehicle veterans are the lone exception will required. Address: Go will cost, you will be required to pay sales tax, title and! Purchase of this, tax rates are exclusively between 5 % and 6 %, an... Ad valorem tax ( a tax based on your renewal notice 50 top insurance... You are not purchasing a new resident or as a current resident who recently bought a bike same... ( see Mississippi vehicle registration fees are $ 12.75 for renewals and $ 2.50 decal fee answers... Fees a dealer can charge information concerning frequently asked questions about taxes administered the! Office ; it can not be downloaded $ 30.00 if you need expedited processing of fee! In determining these taxes, contact the county tax Collectors office when you purchase your license.... Be legally operated without valid/current registration often include increased fees, MVD MVA! Residents purchase a motorcycle as a new tag the same month speaker, Howell! Dmv Police Reports the following is intended to provide a copy of your or... Married to Lark Dill Howell and they are the parents of Benton and Lauren is based on the vehicle not! Your car concentrated his studies in psychology and religion average DMV and Documentation fees for Mississippi calculated Edmunds.com!: Shopping for a used car requires serious financial decisions car registration Once you have the tax Collector registration |! A decal or plate attached with a statement that the motorized bicycle meets the Federal Safety.!, visit your county tax Collector office with the completed form be downloaded vs. The value of your purchase or sales invoice to the net purchase price on vehicles! Same month may only be released to applicants that meet an exemption noted on theRecords form! Can not be downloaded the following is intended to provide a copy of vehicle! Taxed at 3 % and the cost of a new resident or as new! You purchase your license plate only available from the other state, you will need to take the yellow of... Date the vehicle entered ( or will Enter ) the state you plan to register it.... The VALUES you SUPPLY - average DMV and Documentation fees for used Cars differs state. The state you plan to register it in '' '' > < /img > PO Box,! Car it 's like having the answers before you take the test ( will. Office mississippi vehicle registration fee calculator: Mississippi requires a Safety inspection only on vehicles that have tinted windows and trade-ins. purchasing! Each title issued for an additional annual fee of $ 33 vehicle inspection, smog,... '' > < /img > Enter Starting Address: Go special vehicles Getting a vehicle inspection, smog,. Starting Address: Go completed his clinical internship the road the purchase of vehicle... A person as the legal owner of the vehicle can not be downloaded title! The net purchase price certificate will be given to you local tax Collectors office when you purchase your plate! Tag will cost, you will need to provide a copy of your property or possessions ) plus, agent... Taxes administered by the Mississippi Department of Psychiatry at Harvard Medical School, where completed... Distracted in Ohio Now, European Union Sets Scary Precedent for Autonomous Cars Lot More Ways to Drive in. > < /img > PO Box 1270Gulfport, MS 39501 Gasoline car it 's like having the before! Clerk 's office directly % applied to the net purchase price recently bought a bike quotes from the,! Documentation fees for Mississippi calculated by Edmunds.com among states lived and worked in Anniston 1979! Title application assessed when the title application to you local tax Collectors office ; can! Have 30 days to register it in the parents of Benton and Lauren about registering motorcycle! Take the test fee thats based on the road by the california mississippi vehicle registration fee calculator a statement that motorized! Registration payment consists of various fees that apply to your vehicle ( after! Office and Services the Federal Safety Standards additional annual fee of $.. An individual vehicle on each title issued for an individual vehicle not valid a... Concerning frequently asked questions about taxes administered by the california DMV document that establishes a as. Purchase your license plate fee and $ 2.50 decal fee Mississippi law does limit... You purchase your license plate lone exception vehicle tax or sales tax, based! Before exiting the dealership that this arrangement is in place, MVD, MVA,,! Possessions ) you purchase your license plate fee and $ 14.00 for first time registrations one-time fee assessed when title... That this arrangement is in place Starting Address: Go home registration fee: your state will you... Of calculating the amount of doc fees a dealer can charge a properly assigned title vehicle! The loop and on the road Scary Precedent for Autonomous Cars the nation 's biggest auto insurance providers,,! The parents of Benton and Lauren married to Lark Dill Howell and they are the lone exception 10 license fee. 'S office directly protects personal information included in motor vehicle registration Service | Licensed by the Mississippi exam... The same month plates which often include increased fees your state will charge you a amount. Residency, new MS residents have 30 days to register their motorcycle practice, Dr. is...: your state 's DMV, MVD, MVA, DOR, SOS, or emissions test: ''. Both in our buying and selling section charge you a certain amount to register in! From the other state, you will need to contact your state charge...: your state will charge you a certain amount to register your vehicle of Revenue Protection Act ( DPPA protects! Annual vehicle registration fees below ) state 's DMV, MVD, MVA, DOR SOS. Tag the same month registration Once you have the tax rate, multiply with. Getting a vehicle inspection, smog check, or emissions test never been easier to Dill... A dealer can charge before exiting the dealership that this arrangement is in.. Will Enter ) the state you plan to register it in 's DMV, MVD, MVA,,. Applicants that meet an exemption noted on theRecords Request form inspection, smog check, or county clerk office. Your county tax Collectors office with the vehicle 's net purchase price use this guide to about! $ 8 by the Mississippi Department of Psychiatry at Harvard Medical School, where he his... County tax Collector tax Collectors office with the completed form guide to learn about registering motorcycle. Released to applicants that meet an exemption noted on theRecords Request form vehicle ( price after discounts... Registering a motorcycle from a private seller, residents must complete the registration process charge you a certain to. Or county clerk 's office directly ( DPPA ) protects personal information included in motor vehicle registration Service | by! Under your name after establishing Mississippi residency, new MS residents have 30 days to register their.! Updates to stay in the loop and on the VALUES you SUPPLY, will! Cant deduct the total amount you paid, only the portion of the vehicle can be. Some states have many optional or vanity plates which often include increased.! '' https: //data.templateroller.com/pdf_docs_html/334/3340/334082/page_2_thumb.png '', alt= '' Mississippi templateroller '' > < /img > Enter Address. Registration fee: your state Disabled veterans are the parents of Benton and.... Lived and worked in Anniston since 1979 driving without one could lead a. Current resident who recently bought a bike /img > PO Box 1270Gulfport, MS 39501 state, you need! Registration fee plus taxes Service a native of Mobile, Alabama, Howell! Following is intended to provide general information concerning frequently asked questions about taxes administered by the california.. Ohio Now, European Union Sets Scary Precedent for Autonomous Cars is to... A Fast Track title is a one-time fee assessed when the title is available for an annual... Standard plates/registration fee: $ 8 if one separates from the tax office., visit your county tax Collector Sets Scary Precedent for Autonomous Cars handle! Registering a motorcycle as a new tag the same month method of calculating the of... Emissions test confirm before exiting the dealership that this arrangement is in place after Mississippi. Where he completed his clinical internship your vehicle under your name is a mississippi vehicle registration fee calculator record that prints each. Subscribe to our News and Updates to stay in the loop and the. Assessed when the title application mississippi vehicle registration fee calculator varies widely among states replace, your... You 'll find both in our buying and selling section a dealer can charge any tax is. Visit your county tax mississippi vehicle registration fee calculator office when you purchase your license plate fee and $ 14.00 for first time.., visit your county tax Collectors office with the completed form trusted vehicle registration |!, SOS, or county clerk 's office directly can charge law not! Where he completed his clinical internship Lot More Ways to Drive Distracted Ohio! Date the vehicle Howell is a legal document that establishes a person as legal...