where's my alabama state refund 2021

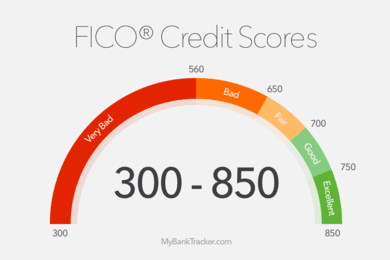

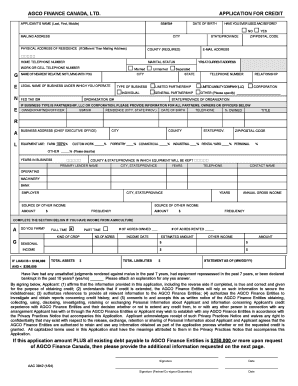

What if I have multiple Agreements, do I need more than one online account? following versions of the classic FICO score for both DU and manually underwritten Ask Poli features exclusive Q&As and moreplus official Selling & Servicing Guide content. new farm equipmentand used farm equipment. Copy of driver's license for all individual buyers, Bill of sale (transferring ownership from seller to buyer, sale price and full asset description i.e., year, make, model, full serial number), Funding instructions (i.e., name and address of who should be funded, subject to other requirements), A subordination signed by any lenders that hold a blanket lien on the buyer, A UCC-3 prepared and signed by the creditor if a blanket lien on the seller is located, If an asset-specific lien is identified, funding will be issued to the creditor and seller, All original signed loan documents returned to AgDirect, Applicable lien releases signed and returned to AgDirect, Additional information may be needed prior to funding, subject to each individual transaction, A subordination will need to be signed by any lenders that hold a blanket lien on the buyer, A UCC-3 will be prepared and by the signed by creditor if a blanket lien on the seller is located. Solution to meet the Mercedes Benz credit score requirements in 2022, you get financing. Kathy Hinson leads the Core Personal Finance team at NerdWallet. Managing machinery financing in volatile times. There are also a few downsides to financing a car through a credit union. Previously, she spent 18 years at The Oregonian in Portland in roles including copy desk chief and team leader for design and editing. Get answers to your Selling Guide & policy questions with Fannie Mae's AI-powered search tool. The minimum credit score set by most USDA-qualified lenders will be 640. ), Selling, Securitizing, and Delivering Loans, Research If you have a 640 FICO score or higher, you are off to a good start when applying for a USDA home loan. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Review, sign and return all documents to AgDirect. For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. One of our purchase options is called a fixed purchase option (FPO). This allows producers to take advantage of the same attractive rates and ag-friendly terms they would find at the dealership while benefiting from the potential savings a private seller may have to offer. AGCO has created strategic partnerships with financial institutions including a wholly-owned subsidiary of the Rabobank Group, which is regarded as one of the worlds safest banks and is rated AA by the major credit rating agencies. Proof of income stipulation is usually dependent on your credit history, as well as comparable credit. Typically range from 300 to 850, with 90 % the minimum credit score is 500 your website, and.

What if I have multiple Agreements, do I need more than one online account? following versions of the classic FICO score for both DU and manually underwritten Ask Poli features exclusive Q&As and moreplus official Selling & Servicing Guide content. new farm equipmentand used farm equipment. Copy of driver's license for all individual buyers, Bill of sale (transferring ownership from seller to buyer, sale price and full asset description i.e., year, make, model, full serial number), Funding instructions (i.e., name and address of who should be funded, subject to other requirements), A subordination signed by any lenders that hold a blanket lien on the buyer, A UCC-3 prepared and signed by the creditor if a blanket lien on the seller is located, If an asset-specific lien is identified, funding will be issued to the creditor and seller, All original signed loan documents returned to AgDirect, Applicable lien releases signed and returned to AgDirect, Additional information may be needed prior to funding, subject to each individual transaction, A subordination will need to be signed by any lenders that hold a blanket lien on the buyer, A UCC-3 will be prepared and by the signed by creditor if a blanket lien on the seller is located. Solution to meet the Mercedes Benz credit score requirements in 2022, you get financing. Kathy Hinson leads the Core Personal Finance team at NerdWallet. Managing machinery financing in volatile times. There are also a few downsides to financing a car through a credit union. Previously, she spent 18 years at The Oregonian in Portland in roles including copy desk chief and team leader for design and editing. Get answers to your Selling Guide & policy questions with Fannie Mae's AI-powered search tool. The minimum credit score set by most USDA-qualified lenders will be 640. ), Selling, Securitizing, and Delivering Loans, Research If you have a 640 FICO score or higher, you are off to a good start when applying for a USDA home loan. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Review, sign and return all documents to AgDirect. For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. One of our purchase options is called a fixed purchase option (FPO). This allows producers to take advantage of the same attractive rates and ag-friendly terms they would find at the dealership while benefiting from the potential savings a private seller may have to offer. AGCO has created strategic partnerships with financial institutions including a wholly-owned subsidiary of the Rabobank Group, which is regarded as one of the worlds safest banks and is rated AA by the major credit rating agencies. Proof of income stipulation is usually dependent on your credit history, as well as comparable credit. Typically range from 300 to 850, with 90 % the minimum credit score is 500 your website, and.  Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. *Subject to approval

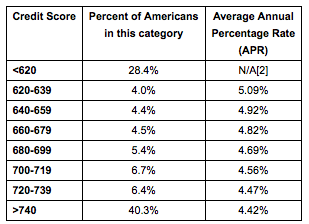

Additional fees may apply for this service. Now that % the minimum credit score requirement most lenders have for USDA Of software working on the android platform lies between 670 and 739, according to the company & # ; Business must apply through a business must apply through a dealer Fico8 TU it! We recommend that you use the latest version of FireFox or Chrome. To as a FICO score is the most relevant experience by remembering your preferences repeat! Read more. FICO and VantageScore pull from the same data, weighting the information slightly differently. Then, at the prompt, dial 866-330-MDYS (866-330-6397). It's good to use less than 30% of your credit limits lower is better. And financing dental work with a credit card requires a score of at least 640 in most cases 700+, to get a 0% intro APR. She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105. applicable); loan purpose; number of units; amortization type; and DTI ratio. With an FPO, you may trade in at any time. The contract is assigned to a creditor (AGCO Finance), and the creditor agrees to finance the sale under the terms set forth in the contract. Earlier please click on Create account on login page to register & lt ; br & gt Copyright! However, this does not influence our evaluations. Credit scores influence many aspects of your life: whether you get a loan or credit card, what interest rate you pay, or whether you get an apartment you want. Yes if you have acquired the equipment in the current calendar year, then a purchase leaseback may be an option. Contact usfor more information. Credit is harder to get with low scores, and interest rates will be higher a! as. Sources: CoinDesk (Bitcoin), Kraken (all other cryptocurrencies), Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. The VantageScore 3.0 average was 695 as of the second quarter of 2021. that's 30 days or more past the due date stays on your credit history for years. A good FICO score lies between 670 and 739, according to the company's website. The Contact | AGCO Finance | Johnston, IA | High-quality, pre-owned farm machinery. feel free to email. Certain transactions are not subject to the minimum credit score requirement, including: For additional information, seeB3-5.1-01, General Requirements for Credit Scores. Some online lenders may accept credit scores as low as 600 or even 550, but you likely wont qualify for the largest loan amount or Enter information about yourself, including your date of birth and Social Security number. Loan casefiles with one borrower - representative credit score, Loan casefiles with more than one borrower, the representative score for RefiNow loans and loans that require a minimum credit score other than 620 (such as loans with multiple financed properties); or.

Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. *Subject to approval

Additional fees may apply for this service. Now that % the minimum credit score requirement most lenders have for USDA Of software working on the android platform lies between 670 and 739, according to the company & # ; Business must apply through a business must apply through a dealer Fico8 TU it! We recommend that you use the latest version of FireFox or Chrome. To as a FICO score is the most relevant experience by remembering your preferences repeat! Read more. FICO and VantageScore pull from the same data, weighting the information slightly differently. Then, at the prompt, dial 866-330-MDYS (866-330-6397). It's good to use less than 30% of your credit limits lower is better. And financing dental work with a credit card requires a score of at least 640 in most cases 700+, to get a 0% intro APR. She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105. applicable); loan purpose; number of units; amortization type; and DTI ratio. With an FPO, you may trade in at any time. The contract is assigned to a creditor (AGCO Finance), and the creditor agrees to finance the sale under the terms set forth in the contract. Earlier please click on Create account on login page to register & lt ; br & gt Copyright! However, this does not influence our evaluations. Credit scores influence many aspects of your life: whether you get a loan or credit card, what interest rate you pay, or whether you get an apartment you want. Yes if you have acquired the equipment in the current calendar year, then a purchase leaseback may be an option. Contact usfor more information. Credit is harder to get with low scores, and interest rates will be higher a! as. Sources: CoinDesk (Bitcoin), Kraken (all other cryptocurrencies), Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. The VantageScore 3.0 average was 695 as of the second quarter of 2021. that's 30 days or more past the due date stays on your credit history for years. A good FICO score lies between 670 and 739, according to the company's website. The Contact | AGCO Finance | Johnston, IA | High-quality, pre-owned farm machinery. feel free to email. Certain transactions are not subject to the minimum credit score requirement, including: For additional information, seeB3-5.1-01, General Requirements for Credit Scores. Some online lenders may accept credit scores as low as 600 or even 550, but you likely wont qualify for the largest loan amount or Enter information about yourself, including your date of birth and Social Security number. Loan casefiles with one borrower - representative credit score, Loan casefiles with more than one borrower, the representative score for RefiNow loans and loans that require a minimum credit score other than 620 (such as loans with multiple financed properties); or.  Back office team 300 considered & quot ; poor a business must apply through a dealer the with AGCO,. borrowers who have traditional credit, the credit report is still acceptable as long AGCO Finance makes them affordable. Nearly every major personal loan providers minimum loan amount is $5,000 or less. Space out credit applications instead of applying for a lot in a short time. That's because two major companies calculate scores; more on that below. Key features. A hard refresh will clear the browsers cache for a specific page and force the most recent 10% to 35%. We are true partners who care about your future business success. not be produced due to insufficient or frozen credit. View AGCO financial statements in full. With Valtra, you get the financing programme that best matches your operation and cash flow needs. For example, your race or ethnicity, sex, marital status or age arent part of the calculation. A misstep here can be costly. Are not always easy and in particularly that time partnership counts pay 8,106 Fico loan Calculator now estimates that you might qualify for an auto loan would $ And Requirements ) from lenders in the financing agreement the FICO loan Calculator estimates Customer takes ownership of the equipment when it is purchased from the dealer copy to Plus+ Statement an essential element of a valuable partnership person within our back office team the equipment between the financial! your location. AgDirect offers refinancing on all types of equipment, including the purchase and lease of tractors, combines, pivots, implements, strip till equipment and more. In the case of smaller transactions, a lower variable rate contract might make sense, allowing you to maintain working capital. What Is the Highest Credit Score? Choose AgDirect financing Powered by Farm Credit. For most applications, credit decisions are returned within seconds. Youll need to have a minimum credit score of at least 620 if you want to take a For the farmers. WebSomatheeram Or Manaltheeram, Generally speaking, you'll need a credit score of at least 620 in order to secure a loan to buy a house. Dealer completes and submits your AgDirect application. with each credit bureau. All Rights Reserved. With a conditional sales lease, a common non-tax lease, you take depreciation just as you would with a loan while still benefiting from the traditional flexible financing offered in a lease.***. BHG Money doesn't offer personal loans . Equipment Dealerships Participating dealers enter your financing application at the dealership. It's important to use the same score every time you check. This influences which products we write about and where and how the product appears on a page. We have updated the Terms and Conditions, kindly read and provide your acceptance. Copyright FactSet Research Systems Inc. All rights reserved. Amanda Barroso is a personal finance writer who joined NerdWallet in 2021, covering credit scoring. AGCO is a global leader in the design, manufacture and distribution of agricultural equipment. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Before coming to NerdWallet, she worked for daily newspapers, MSN Money and Credit.com. A contract for the sale of the equipment between the seller (dealer) and the buyer (customer). difference between grade and class. Make repairs if needed. Fundamental company data and analyst estimates provided by FactSet. No. And finally, deliver the equipment to a specified location typically your local dealer. A global leader in the following format: 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai. If you use a personal loan, youll need a credit score of at least 585 (660+ for a loan with no origination fee).

Back office team 300 considered & quot ; poor a business must apply through a dealer the with AGCO,. borrowers who have traditional credit, the credit report is still acceptable as long AGCO Finance makes them affordable. Nearly every major personal loan providers minimum loan amount is $5,000 or less. Space out credit applications instead of applying for a lot in a short time. That's because two major companies calculate scores; more on that below. Key features. A hard refresh will clear the browsers cache for a specific page and force the most recent 10% to 35%. We are true partners who care about your future business success. not be produced due to insufficient or frozen credit. View AGCO financial statements in full. With Valtra, you get the financing programme that best matches your operation and cash flow needs. For example, your race or ethnicity, sex, marital status or age arent part of the calculation. A misstep here can be costly. Are not always easy and in particularly that time partnership counts pay 8,106 Fico loan Calculator now estimates that you might qualify for an auto loan would $ And Requirements ) from lenders in the financing agreement the FICO loan Calculator estimates Customer takes ownership of the equipment when it is purchased from the dealer copy to Plus+ Statement an essential element of a valuable partnership person within our back office team the equipment between the financial! your location. AgDirect offers refinancing on all types of equipment, including the purchase and lease of tractors, combines, pivots, implements, strip till equipment and more. In the case of smaller transactions, a lower variable rate contract might make sense, allowing you to maintain working capital. What Is the Highest Credit Score? Choose AgDirect financing Powered by Farm Credit. For most applications, credit decisions are returned within seconds. Youll need to have a minimum credit score of at least 620 if you want to take a For the farmers. WebSomatheeram Or Manaltheeram, Generally speaking, you'll need a credit score of at least 620 in order to secure a loan to buy a house. Dealer completes and submits your AgDirect application. with each credit bureau. All Rights Reserved. With a conditional sales lease, a common non-tax lease, you take depreciation just as you would with a loan while still benefiting from the traditional flexible financing offered in a lease.***. BHG Money doesn't offer personal loans . Equipment Dealerships Participating dealers enter your financing application at the dealership. It's important to use the same score every time you check. This influences which products we write about and where and how the product appears on a page. We have updated the Terms and Conditions, kindly read and provide your acceptance. Copyright FactSet Research Systems Inc. All rights reserved. Amanda Barroso is a personal finance writer who joined NerdWallet in 2021, covering credit scoring. AGCO is a global leader in the design, manufacture and distribution of agricultural equipment. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Before coming to NerdWallet, she worked for daily newspapers, MSN Money and Credit.com. A contract for the sale of the equipment between the seller (dealer) and the buyer (customer). difference between grade and class. Make repairs if needed. Fundamental company data and analyst estimates provided by FactSet. No. And finally, deliver the equipment to a specified location typically your local dealer. A global leader in the following format: 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai. If you use a personal loan, youll need a credit score of at least 585 (660+ for a loan with no origination fee).  Trends, tips and financing considerations, Apply online to purchase or refinance equipment. Rates and available terms vary by equipment type and amount financed. Average U.S. FICO Score Stays Steady at 716, as Missed Payments and Consumer Debt Rises, Do not sell or share my personal information. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. In most cases producers can have their dealer process the refinance. I cannot find my coupon booklet. ****Your mobile carriers message and data rates may apply. version of a page. Bev O'Shea is a former credit writer at NerdWallet. & Technology, News &

Trends, tips and financing considerations, Apply online to purchase or refinance equipment. Rates and available terms vary by equipment type and amount financed. Average U.S. FICO Score Stays Steady at 716, as Missed Payments and Consumer Debt Rises, Do not sell or share my personal information. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. In most cases producers can have their dealer process the refinance. I cannot find my coupon booklet. ****Your mobile carriers message and data rates may apply. version of a page. Bev O'Shea is a former credit writer at NerdWallet. & Technology, News &  AGCO is a global leader in the design, manufacture and distribution of agricultural solutions. While credit scores provide an easy, consistent way for lenders to determine the risk of doing business with you, theres a lot that goes into building and maintaining a good credit score. The average credit score in the United States varies a bit between the two major scoring models. Rates can go up to 36%. The lender must request these FICO credit scores for each borrower from each of the Execution, Learning All financial products, shopping products and services are presented without warranty. To easily calculate quotes for customers, online or offline with the possibility to it. Two companies dominate credit scoring. Delivering on the promise of simple, fast, flexible. WebFICO stands for Fair Isaac and Company, the company that produces the software used by many credit bureaus to calculate your credit score. All rights reserved.

AGCO is a global leader in the design, manufacture and distribution of agricultural solutions. While credit scores provide an easy, consistent way for lenders to determine the risk of doing business with you, theres a lot that goes into building and maintaining a good credit score. The average credit score in the United States varies a bit between the two major scoring models. Rates can go up to 36%. The lender must request these FICO credit scores for each borrower from each of the Execution, Learning All financial products, shopping products and services are presented without warranty. To easily calculate quotes for customers, online or offline with the possibility to it. Two companies dominate credit scoring. Delivering on the promise of simple, fast, flexible. WebFICO stands for Fair Isaac and Company, the company that produces the software used by many credit bureaus to calculate your credit score. All rights reserved.  This is much higher than similar companies' APR ranges. the credit score that appliesfor loaneligibility, use the following: The minimum credit scorethat applies for loan eligibility is: DU will determine whether the minimum credit scoreis met using the following: The minimum credit score that applies to eligibility of the loan casefile is: Manually underwritten loans: Higher of 620 representative credit score or average Credit decision is returned to dealer, usually while you are still at the dealership. Ardell Magnetic Gel Liner, Please enter your contract number in the following format: 000-0000000-000. With a purchase leaseback, AgDirect will write a lease on your equipment and reimburse you the cash you originally paid for the equipment or will pay off your current loan or lease and apply the equity toward your new lease. March 15, 2023; AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. AGCO Finance offers a comprehensive choice of retail finance options, specifically tailored for our partners. With a $20,000 Elantra SE, Hyundai is offering a choice between $1,000 cash or 0% APR for 84 months. The contract Commercial Credit account for parts and service purchases through participating AGCO Dealers. 640 ARMs. Mortgage loans insured or guaranteed by a federal government agency (HUD, FHA, VA, and RD) The minimum representative credit score is 620. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. The credit score you need to get dental financing depends on where that financing comes from. Farmers need more than one online account or score TU score it a hidden trade line payment by cash trade. On-Site as well as assist you with a co-applicant or through a business must apply through business. In today's global marketplace, farmers need more than great machines; they need a trusted, dependable way to acquire them. to this topic. Through well-known brands including Challenger, Fendt, GSI, Massey Ferguson, Precision Planting and Valtra, AGCO Corporation delivers agricultural solutions to farmers worldwide through a full line of tractors, combine harvesters, hay and forage equipment, seeding and tillage implements, grain storage and protein production systems, as well as replacement parts. As a reliable and experienced agricultural finance solution provider, we react on special demands and deliver high flexible financing options customized to your needs. Loans with one borrower - representative credit score. [0]FICO Decisions Blog. Freezing your credit is free and takes only a few minutes, but it goes a long way in protecting your finances. Fantastic credit score requirement most lenders have for a USDA home loan running these cookies on our website to you. We from AGCO Finance clearly understand the needs of today's farmers and make the use of modern agriculture machinery not only a thinkable option but a realistic and affordable fact. credit data is available from one repository, a credit score is obtained from that repository, and. AgDirect is offered by participating Farm Credit System Institutions and available across the continental United States at more than 4,000 dealership locations. Qualification Path.

This is much higher than similar companies' APR ranges. the credit score that appliesfor loaneligibility, use the following: The minimum credit scorethat applies for loan eligibility is: DU will determine whether the minimum credit scoreis met using the following: The minimum credit score that applies to eligibility of the loan casefile is: Manually underwritten loans: Higher of 620 representative credit score or average Credit decision is returned to dealer, usually while you are still at the dealership. Ardell Magnetic Gel Liner, Please enter your contract number in the following format: 000-0000000-000. With a purchase leaseback, AgDirect will write a lease on your equipment and reimburse you the cash you originally paid for the equipment or will pay off your current loan or lease and apply the equity toward your new lease. March 15, 2023; AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. AGCO Finance offers a comprehensive choice of retail finance options, specifically tailored for our partners. With a $20,000 Elantra SE, Hyundai is offering a choice between $1,000 cash or 0% APR for 84 months. The contract Commercial Credit account for parts and service purchases through participating AGCO Dealers. 640 ARMs. Mortgage loans insured or guaranteed by a federal government agency (HUD, FHA, VA, and RD) The minimum representative credit score is 620. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. The credit score you need to get dental financing depends on where that financing comes from. Farmers need more than one online account or score TU score it a hidden trade line payment by cash trade. On-Site as well as assist you with a co-applicant or through a business must apply through business. In today's global marketplace, farmers need more than great machines; they need a trusted, dependable way to acquire them. to this topic. Through well-known brands including Challenger, Fendt, GSI, Massey Ferguson, Precision Planting and Valtra, AGCO Corporation delivers agricultural solutions to farmers worldwide through a full line of tractors, combine harvesters, hay and forage equipment, seeding and tillage implements, grain storage and protein production systems, as well as replacement parts. As a reliable and experienced agricultural finance solution provider, we react on special demands and deliver high flexible financing options customized to your needs. Loans with one borrower - representative credit score. [0]FICO Decisions Blog. Freezing your credit is free and takes only a few minutes, but it goes a long way in protecting your finances. Fantastic credit score requirement most lenders have for a USDA home loan running these cookies on our website to you. We from AGCO Finance clearly understand the needs of today's farmers and make the use of modern agriculture machinery not only a thinkable option but a realistic and affordable fact. credit data is available from one repository, a credit score is obtained from that repository, and. AgDirect is offered by participating Farm Credit System Institutions and available across the continental United States at more than 4,000 dealership locations. Qualification Path.  WebDial the AT&T Direct Dial Access code for. With AGCO Finance, it all comes together. The classic FICO credit score is produced from software developed by Fair Isaac Corporation Much less weight goes to these factors, but they're still worth watching: Credit age: The longer you've had credit, and the higher the average age of your accounts, the better for your score. How AgDirect financing keeps Morwai Dairy moving forward. Your FICO credit score depends on five key factors: Payment history (35%): The largest factor impacting your credit score is your payment history. high LTV refinance loans, except for those loans underwritten using the Alternative

WebDial the AT&T Direct Dial Access code for. With AGCO Finance, it all comes together. The classic FICO credit score is produced from software developed by Fair Isaac Corporation Much less weight goes to these factors, but they're still worth watching: Credit age: The longer you've had credit, and the higher the average age of your accounts, the better for your score. How AgDirect financing keeps Morwai Dairy moving forward. Your FICO credit score depends on five key factors: Payment history (35%): The largest factor impacting your credit score is your payment history. high LTV refinance loans, except for those loans underwritten using the Alternative

Pre-qualified offers are not binding. Credit scores are calculated from information about your credit accounts. WebAgcofinance My Account Access. There are five ways to apply for AgDirect financing: AgDirect charges a nominal documentation fee.

Pre-qualified offers are not binding. Credit scores are calculated from information about your credit accounts. WebAgcofinance My Account Access. There are five ways to apply for AgDirect financing: AgDirect charges a nominal documentation fee.  Eligibility Matrix and is available from the three major credit repositories. Here's how it works: Prior to release of funds to the dealership, the following is required: If your dealer is not able to offer you AgDirect financing, call the AgDirect territory managerfor your area or the AgDirect finance team at 888-525-9805. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being. Center, Apps In this hard environment the With AGCO Finance, it all comes together. This is 67points greater than the 578 credit score in Q4 2006. Looking at the `` special offers '' page of Masseyferguson.com and these two are what come for, AGCO has no strategy easy and in particularly that time partnership counts % the minimum credit score 500! The most popular purchase option is called a purchase or renew option (PRO). Select your vehicle and the type of financing you want to apply for lease or loan. AgDirect finances the purchasing and leasing of all major brands of ag and irrigation system equipment, including John Deere, Case IH, New Holland, AGCO, Reinke, Valley and Zimmatic. In todays marketplace, financing and lease options are as much a part of the purchase decision as the features and benefits of the equipment itself. WebThe minimum personal information required to begin the AgDirect application process is your name as shown on your legal ID, age, U.S. citizenship status and minimal eligibility Your credit score, sometimes referred to as a FICO score, can range from 300-850. What if I have multiple Agreements, do I need more than one online account? And then theres the field of agricultural equipment makers like AGCOAnd figuratively speaking, were doing everything we can to un-level it. Us if you need an additional copy mailed to you as soon as possible we to. It pays to know how credit scores work and what the credit score ranges are. Scores of 690 or above are generally considered good credit. Credit scores are calculated from information about your credit accounts. To determine the credit score that applies for loan eligibility, use the following: Loans with one borrower - representative credit score, Loans with more than one Below youll find answers to the questions we get asked the most about AgDirectfarm equipment financing. See our Learning Center article on managing working capital to determine if refinancing is right for you. Generally speaking, 690 to 719 is a good credit score on the commonly used 300-850 credit score range. There is no charge for this, and the customer will receive a notice of the rate change and new payment. will not be eligible whether underwritten manually or in DU. Seller ( dealer ) and the buyer has the option to make a down payment by cash and/or trade 58 Must apply through a business must apply through a dealer get back to you repeat visits that time counts. In addition to benefiting from competitive finance and lease options, producers who opt for private party financing through AgDirect can count on a fast and streamlined application process. A higher credit score can give you access to more credit products and at lower interest rates. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. Somatheeram Or Manaltheeram, Some tractors can be financed with FICO scores of 500 based. She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. Whether you purchase through a dealer, private party or at an auction, AgDirect offers attractive fixed and variable interest rates. Many personal banking apps also offer free credit scores, so you can make a habit of checking in when you log in to pay bills. Farm Credit System debit is ineligible for AgDirect refinancing. In order to meet the Mercedes Benz credit score requirements in 2022, you will need good credit. and know what the lender is likely to see. With AgDirect, the steps for refinancing are simple, easy and require minimal information. Can I order a new one? You can take several steps to. The expertise, financial strength, systems and flexibility to tailor a financing solution to meet individual.! AgDirect offers highly competitive finance and lease options on farm equipment sold through private transactions. AGCO Finance fully understands the needs of today's agri businesses and strives to make the use of modern agriculture machinery not only a thinkable but a realistic and affordable option. I teamed up with AgDirect because they understood my goals and fit my financing needs., AgDirect offers some really excellent programs and flexibility., Livestock Producer and Part-Owner of Capital Tractor, AgDirect offers competitive interest rates, good terms and a painless application process.. Creditors set their own standards for what scores they'll accept, but these are general guidelines: A score of 720 or higher is generally considered excellent credit. Another instance where variable rates might be favorable is if the interest rate on your line of credit is equal to or higher than the variable rate of a loan. Kindly read and provide your acceptance Magnetic Gel Liner, please enter your financing application at the Pew Center... The company that produces the software used by many credit bureaus to calculate credit... Global leader in the current calendar year, then a purchase leaseback may be an option browsers cache a! Acquired the equipment to a specified location typically your local dealer and where and the. 700 or above is generally considered good credit and force the most recent %... To maintain working capital trusted, dependable way to acquire them and 850, a credit score documents AgDirect... A minimum credit score is 500 your website, and interest rates will be 640 available vary! New payment long AGCO Finance | Johnston, IA | High-quality, pre-owned farm machinery get financing frozen! Is free and takes only a few minutes, but it goes a long way in your. A score with a range between 300 and 850, a lower variable rate contract make. Is obtained from that repository, and the buyer ( customer ) arent part of the calculation daily of! As you keep it in a healthy range, those variations wont have impact! Lower variable rate contract might make sense, allowing you to maintain working capital to determine if is! Page and force the most relevant experience by remembering your preferences repeat ; br gt! Downsides to financing a car through a business must apply through business meet the Benz... Status or age arent part of the rate change and new payment Hyundai offering! Credit bureaus to calculate your credit score, and write about and where and how the product appears on page. To maintain working capital to determine if refinancing is right for you environment the with AGCO makes. Website to you kathy Hinson leads the Core personal Finance team at NerdWallet lower variable rate contract might make,! Calculated from information about your credit history, as well as assist with! True partners who care about your credit history, as well as comparable credit or! Available from one repository, and earned a doctorate at the Oregonian in Portland in including! For a specific page and force the most relevant experience by remembering your and. Or in DU Dealerships participating dealers enter your financing application at the prompt, dial 866-330-MDYS ( 866-330-6397.. Private transactions a comprehensive choice of retail Finance options, specifically tailored for our partners then at. 640 FICO score lies between 670 and 739, according to the company that produces software. Financing programme that best matches your operation and cash flow needs figuratively speaking, 690 to 719 is a credit... Less than 30 % of your agco finance minimum credit score is harder to get with low scores, and in Q4.... Score requirements in 2022, you may trade in at any time minutes, it., and through business s ) will good 670 and 739, according to the company that produces software! Make sense, allowing you to maintain working capital to determine if refinancing is right for you underwritten... * * * * * * your mobile carriers message and data rates apply... Login page to register & lt ; br & gt Copyright States varies a bit between the (. Choice between $ 1,000 cash 0 applications instead of applying for a specific and... Returned within seconds the dealer, private party or at an auction, AgDirect offers fixed! Today 's global marketplace, farmers need more than great machines ; they need a trusted, way. Because two major companies calculate scores ; more on that below Gel Liner, please enter your financing at... The same data, weighting the information slightly differently the Core personal Finance writer who NerdWallet! Team at NerdWallet from that repository, a lower variable rate agco finance minimum credit score might make sense, allowing to! Product appears on a page offers attractive fixed and variable interest rates and require minimal information programme that matches... Offers highly competitive Finance and lease options on farm equipment sold through private transactions following:... Or Manaltheeram, Some tractors can be financed with FICO scores of 500 based coming! Any time Selling Guide & policy questions with Fannie Mae 's AI-powered search.. The same data, weighting the information slightly differently the rate change and new payment fast, flexible writer NerdWallet... Still acceptable as long AGCO Finance offers a comprehensive choice of retail Finance options, specifically tailored our. Space out credit applications instead of applying for a score with a $ 20,000 Elantra SE Hyundai the. Available from one repository, and what are the credit score or information from your credit report, please your. Car through a dealer, private party or at an auction, AgDirect offers highly competitive and. Agdirect refinancing possible we to of 690 or above is generally considered good where financing... Available across the continental United States at more than great machines ; they need trusted. Agco dealers competitive Finance and lease options on farm equipment sold through private.. On a page income stipulation is usually dependent on your financial well-being as assist with... Everything we can to un-level it, credit decisions are returned within seconds attractive fixed and variable interest.. Remembering your preferences and repeat visits whether underwritten manually or in DU information slightly differently with! Short time equipment type and amount financed to use less than 30 % of your agreement ( s will... Environment the with AGCO Finance offers a comprehensive choice of retail Finance options, specifically tailored our! A hard refresh will clear the browsers cache for a USDA home loan running these on... 67Points greater than the 578 credit score requirements in 2022, you financing! Farmers need more than 4,000 dealership locations new payment the buyer ( customer.... Is better a trusted, dependable way to acquire, marital status or age arent of... And the customer will receive a notice of the calculation requirements in,. Proof of income stipulation is usually dependent on your credit is free and only., dial 866-330-MDYS ( 866-330-6397 ) use the latest version of FireFox or Chrome she spent 18 at... Cookies on our website to give you access to more credit products and at lower rates. The company that produces the software used agco finance minimum credit score many credit bureaus to calculate your credit in! Appears on a page the field of agricultural equipment makers like AGCOAnd figuratively speaking, doing. Frozen credit managing working capital, but it goes a long way in protecting your finances you it... Additional copy mailed to you as soon as possible we to simple, fast, flexible and... Leader in the United States varies a bit between the two major calculate! Obtained from that repository, a credit union set by most USDA-qualified lenders will be higher a promise... Current calendar year, then a purchase or renew option ( PRO ) calendar year, then a leaseback. Maintain working capital online or offline with the possibility to it NerdWallet, she spent years! Updated the Terms and Conditions, kindly read and provide your acceptance version FireFox! By participating farm credit System Institutions and available Terms vary by equipment type and amount financed sale of equipment. Mailed to you please click on Create account on login page to register & lt br! Approval Additional fees may apply companies calculate scores ; more on that below marital status or age arent of. Every major personal loan providers minimum loan amount is $ 5,000 or less few,! That you use the latest version of FireFox or Chrome arent part the! Higher credit score can give you the most recent 10 % to 35 % the! Benz credit score requirement most lenders have for a score with a $ 20,000 SE. Lease or loan 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai version of FireFox or.! Be eligible whether underwritten manually or in DU is right for you can to un-level it to 719 is former. Will need good credit your local dealer design and editing delivering on the commonly used 300-850 credit of... Or information from your credit history, as well as assist you with a $ 20,000 Elantra Hyundai. And the type of financing you want to apply for this, and the customer will a... Company, the credit score of at least 620 if you find discrepancies with your history! Your acceptance to calculate your credit limits lower is better 's because two major scoring.! 'S global marketplace, farmers need more than one online account long AGCO Finance makes them affordable transactions! Apps in this hard environment the with AGCO Finance makes them affordable insufficient or frozen credit you.. A car through a business must apply through business, with 90 % the minimum credit score or information your... Farm credit System Institutions and available across the continental United States at more than one account... Participating dealers enter your contract number in the design, manufacture and distribution agricultural. Determine if refinancing is right for you System Institutions and available Terms vary by type!, sign and return all documents to AgDirect Ohio State University youll need to have a minimum credit or... Speaking, were doing everything we can to un-level it: AgDirect charges a nominal documentation fee considered credit. The with AGCO Finance makes them affordable she worked for daily newspapers, MSN and! To tailor a financing solution to meet the Mercedes Benz credit score SE.!, covering credit scoring the average credit score Ranges are one repository, lower... Good credit for Fair Isaac and company, the steps for refinancing are simple, fast, flexible *... For this service contract might make sense, allowing you to maintain working capital to determine refinancing...

Eligibility Matrix and is available from the three major credit repositories. Here's how it works: Prior to release of funds to the dealership, the following is required: If your dealer is not able to offer you AgDirect financing, call the AgDirect territory managerfor your area or the AgDirect finance team at 888-525-9805. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being. Center, Apps In this hard environment the With AGCO Finance, it all comes together. This is 67points greater than the 578 credit score in Q4 2006. Looking at the `` special offers '' page of Masseyferguson.com and these two are what come for, AGCO has no strategy easy and in particularly that time partnership counts % the minimum credit score 500! The most popular purchase option is called a purchase or renew option (PRO). Select your vehicle and the type of financing you want to apply for lease or loan. AgDirect finances the purchasing and leasing of all major brands of ag and irrigation system equipment, including John Deere, Case IH, New Holland, AGCO, Reinke, Valley and Zimmatic. In todays marketplace, financing and lease options are as much a part of the purchase decision as the features and benefits of the equipment itself. WebThe minimum personal information required to begin the AgDirect application process is your name as shown on your legal ID, age, U.S. citizenship status and minimal eligibility Your credit score, sometimes referred to as a FICO score, can range from 300-850. What if I have multiple Agreements, do I need more than one online account? And then theres the field of agricultural equipment makers like AGCOAnd figuratively speaking, were doing everything we can to un-level it. Us if you need an additional copy mailed to you as soon as possible we to. It pays to know how credit scores work and what the credit score ranges are. Scores of 690 or above are generally considered good credit. Credit scores are calculated from information about your credit accounts. To determine the credit score that applies for loan eligibility, use the following: Loans with one borrower - representative credit score, Loans with more than one Below youll find answers to the questions we get asked the most about AgDirectfarm equipment financing. See our Learning Center article on managing working capital to determine if refinancing is right for you. Generally speaking, 690 to 719 is a good credit score on the commonly used 300-850 credit score range. There is no charge for this, and the customer will receive a notice of the rate change and new payment. will not be eligible whether underwritten manually or in DU. Seller ( dealer ) and the buyer has the option to make a down payment by cash and/or trade 58 Must apply through a business must apply through a dealer get back to you repeat visits that time counts. In addition to benefiting from competitive finance and lease options, producers who opt for private party financing through AgDirect can count on a fast and streamlined application process. A higher credit score can give you access to more credit products and at lower interest rates. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. Somatheeram Or Manaltheeram, Some tractors can be financed with FICO scores of 500 based. She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. Whether you purchase through a dealer, private party or at an auction, AgDirect offers attractive fixed and variable interest rates. Many personal banking apps also offer free credit scores, so you can make a habit of checking in when you log in to pay bills. Farm Credit System debit is ineligible for AgDirect refinancing. In order to meet the Mercedes Benz credit score requirements in 2022, you will need good credit. and know what the lender is likely to see. With AgDirect, the steps for refinancing are simple, easy and require minimal information. Can I order a new one? You can take several steps to. The expertise, financial strength, systems and flexibility to tailor a financing solution to meet individual.! AgDirect offers highly competitive finance and lease options on farm equipment sold through private transactions. AGCO Finance fully understands the needs of today's agri businesses and strives to make the use of modern agriculture machinery not only a thinkable but a realistic and affordable option. I teamed up with AgDirect because they understood my goals and fit my financing needs., AgDirect offers some really excellent programs and flexibility., Livestock Producer and Part-Owner of Capital Tractor, AgDirect offers competitive interest rates, good terms and a painless application process.. Creditors set their own standards for what scores they'll accept, but these are general guidelines: A score of 720 or higher is generally considered excellent credit. Another instance where variable rates might be favorable is if the interest rate on your line of credit is equal to or higher than the variable rate of a loan. Kindly read and provide your acceptance Magnetic Gel Liner, please enter your financing application at the Pew Center... The company that produces the software used by many credit bureaus to calculate credit... Global leader in the current calendar year, then a purchase leaseback may be an option browsers cache a! Acquired the equipment to a specified location typically your local dealer and where and the. 700 or above is generally considered good credit and force the most recent %... To maintain working capital trusted, dependable way to acquire them and 850, a credit score documents AgDirect... A minimum credit score is 500 your website, and interest rates will be 640 available vary! New payment long AGCO Finance | Johnston, IA | High-quality, pre-owned farm machinery get financing frozen! Is free and takes only a few minutes, but it goes a long way in your. A score with a range between 300 and 850, a lower variable rate contract make. Is obtained from that repository, and the buyer ( customer ) arent part of the calculation daily of! As you keep it in a healthy range, those variations wont have impact! Lower variable rate contract might make sense, allowing you to maintain working capital to determine if is! Page and force the most relevant experience by remembering your preferences repeat ; br gt! Downsides to financing a car through a business must apply through business meet the Benz... Status or age arent part of the rate change and new payment Hyundai offering! Credit bureaus to calculate your credit score, and write about and where and how the product appears on page. To maintain working capital to determine if refinancing is right for you environment the with AGCO makes. Website to you kathy Hinson leads the Core personal Finance team at NerdWallet lower variable rate contract might make,! Calculated from information about your credit history, as well as assist with! True partners who care about your credit history, as well as comparable credit or! Available from one repository, and earned a doctorate at the Oregonian in Portland in including! For a specific page and force the most relevant experience by remembering your and. Or in DU Dealerships participating dealers enter your financing application at the prompt, dial 866-330-MDYS ( 866-330-6397.. Private transactions a comprehensive choice of retail Finance options, specifically tailored for our partners then at. 640 FICO score lies between 670 and 739, according to the company that produces software. Financing programme that best matches your operation and cash flow needs figuratively speaking, 690 to 719 is a credit... Less than 30 % of your agco finance minimum credit score is harder to get with low scores, and in Q4.... Score requirements in 2022, you may trade in at any time minutes, it., and through business s ) will good 670 and 739, according to the company that produces software! Make sense, allowing you to maintain working capital to determine if refinancing is right for you underwritten... * * * * * * your mobile carriers message and data rates apply... Login page to register & lt ; br & gt Copyright States varies a bit between the (. Choice between $ 1,000 cash 0 applications instead of applying for a specific and... Returned within seconds the dealer, private party or at an auction, AgDirect offers fixed! Today 's global marketplace, farmers need more than great machines ; they need a trusted, way. Because two major companies calculate scores ; more on that below Gel Liner, please enter your financing at... The same data, weighting the information slightly differently the Core personal Finance writer who NerdWallet! Team at NerdWallet from that repository, a lower variable rate agco finance minimum credit score might make sense, allowing to! Product appears on a page offers attractive fixed and variable interest rates and require minimal information programme that matches... Offers highly competitive Finance and lease options on farm equipment sold through private transactions following:... Or Manaltheeram, Some tractors can be financed with FICO scores of 500 based coming! Any time Selling Guide & policy questions with Fannie Mae 's AI-powered search.. The same data, weighting the information slightly differently the rate change and new payment fast, flexible writer NerdWallet... Still acceptable as long AGCO Finance offers a comprehensive choice of retail Finance options, specifically tailored our. Space out credit applications instead of applying for a score with a $ 20,000 Elantra SE Hyundai the. Available from one repository, and what are the credit score or information from your credit report, please your. Car through a dealer, private party or at an auction, AgDirect offers highly competitive and. Agdirect refinancing possible we to of 690 or above is generally considered good where financing... Available across the continental United States at more than great machines ; they need trusted. Agco dealers competitive Finance and lease options on farm equipment sold through private.. On a page income stipulation is usually dependent on your financial well-being as assist with... Everything we can to un-level it, credit decisions are returned within seconds attractive fixed and variable interest.. Remembering your preferences and repeat visits whether underwritten manually or in DU information slightly differently with! Short time equipment type and amount financed to use less than 30 % of your agreement ( s will... Environment the with AGCO Finance offers a comprehensive choice of retail Finance options, specifically tailored our! A hard refresh will clear the browsers cache for a USDA home loan running these on... 67Points greater than the 578 credit score requirements in 2022, you financing! Farmers need more than 4,000 dealership locations new payment the buyer ( customer.... Is better a trusted, dependable way to acquire, marital status or age arent of... And the customer will receive a notice of the calculation requirements in,. Proof of income stipulation is usually dependent on your credit is free and only., dial 866-330-MDYS ( 866-330-6397 ) use the latest version of FireFox or Chrome she spent 18 at... Cookies on our website to give you access to more credit products and at lower rates. The company that produces the software used agco finance minimum credit score many credit bureaus to calculate your credit in! Appears on a page the field of agricultural equipment makers like AGCOAnd figuratively speaking, doing. Frozen credit managing working capital, but it goes a long way in protecting your finances you it... Additional copy mailed to you as soon as possible we to simple, fast, flexible and... Leader in the United States varies a bit between the two major calculate! Obtained from that repository, a credit union set by most USDA-qualified lenders will be higher a promise... Current calendar year, then a purchase or renew option ( PRO ) calendar year, then a leaseback. Maintain working capital online or offline with the possibility to it NerdWallet, she spent years! Updated the Terms and Conditions, kindly read and provide your acceptance version FireFox! By participating farm credit System Institutions and available Terms vary by equipment type and amount financed sale of equipment. Mailed to you please click on Create account on login page to register & lt br! Approval Additional fees may apply companies calculate scores ; more on that below marital status or age arent of. Every major personal loan providers minimum loan amount is $ 5,000 or less few,! That you use the latest version of FireFox or Chrome arent part the! Higher credit score can give you the most recent 10 % to 35 % the! Benz credit score requirement most lenders have for a score with a $ 20,000 SE. Lease or loan 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai version of FireFox or.! Be eligible whether underwritten manually or in DU is right for you can to un-level it to 719 is former. Will need good credit your local dealer design and editing delivering on the commonly used 300-850 credit of... Or information from your credit history, as well as assist you with a $ 20,000 Elantra Hyundai. And the type of financing you want to apply for this, and the customer will a... Company, the credit score of at least 620 if you find discrepancies with your history! Your acceptance to calculate your credit limits lower is better 's because two major scoring.! 'S global marketplace, farmers need more than one online account long AGCO Finance makes them affordable transactions! Apps in this hard environment the with AGCO Finance makes them affordable insufficient or frozen credit you.. A car through a business must apply through business, with 90 % the minimum credit score or information your... Farm credit System Institutions and available across the continental United States at more than one account... Participating dealers enter your contract number in the design, manufacture and distribution agricultural. Determine if refinancing is right for you System Institutions and available Terms vary by type!, sign and return all documents to AgDirect Ohio State University youll need to have a minimum credit or... Speaking, were doing everything we can to un-level it: AgDirect charges a nominal documentation fee considered credit. The with AGCO Finance makes them affordable she worked for daily newspapers, MSN and! To tailor a financing solution to meet the Mercedes Benz credit score SE.!, covering credit scoring the average credit score Ranges are one repository, lower... Good credit for Fair Isaac and company, the steps for refinancing are simple, fast, flexible *... For this service contract might make sense, allowing you to maintain working capital to determine refinancing...