You'll then get your estimated take home pay, an estimated breakdown of your potential tax liability, and a quick summary down here so you can have a better idea of what to possibly expect when planning your budget. wanted to know what my salary after tax was.  Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one. Tennessee collects an unemployment tax from most companies. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Another tax that will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes. If I live in Tennessee but work in another state, how do I calculate my taxes? Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. What is the difference between bi-weekly and semi-monthly?

Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one. Tennessee collects an unemployment tax from most companies. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Another tax that will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes. If I live in Tennessee but work in another state, how do I calculate my taxes? Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. What is the difference between bi-weekly and semi-monthly?  The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. Tennessee (TN) State Payroll Taxes in 2023. 9.25%.

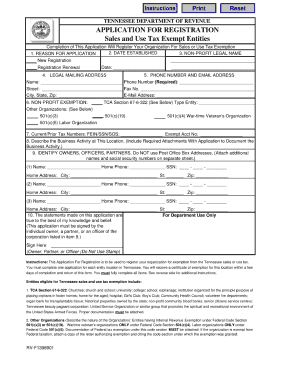

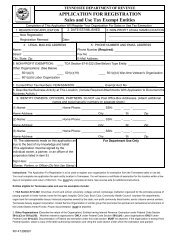

The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. Tennessee (TN) State Payroll Taxes in 2023. 9.25%.  Is there state income tax in TN? For the calendar year 2023, Tennessee unemployment insurance rates range from 0.01% to 10%, with a taxable wage base of up to $7,000 per employee per year. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent. None. published by the Tennessee Department of Revenue The state imposes a franchise tax and an excise tax on corporations, limited partnerships, limited liability companies and other entities. That's right. The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. New employers pay a flat rate of 2.7%. In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. Are you sure you want to rest your choices? Tennessees income tax is simple with a flat rate of 0%.

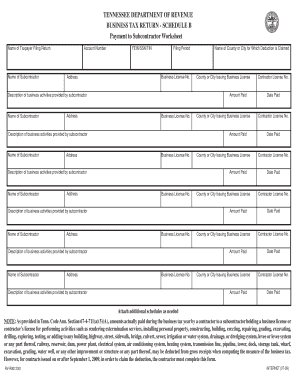

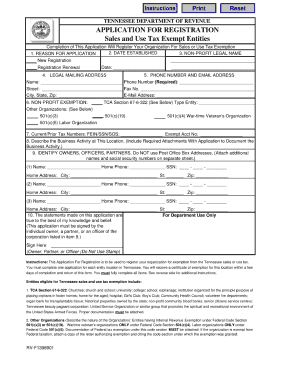

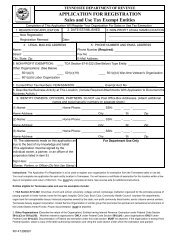

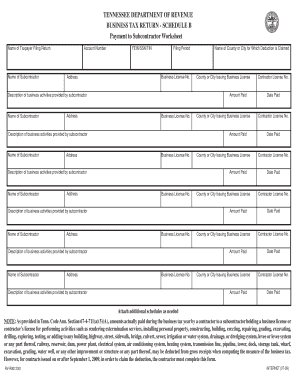

Is there state income tax in TN? For the calendar year 2023, Tennessee unemployment insurance rates range from 0.01% to 10%, with a taxable wage base of up to $7,000 per employee per year. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent. None. published by the Tennessee Department of Revenue The state imposes a franchise tax and an excise tax on corporations, limited partnerships, limited liability companies and other entities. That's right. The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. New employers pay a flat rate of 2.7%. In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. Are you sure you want to rest your choices? Tennessees income tax is simple with a flat rate of 0%.  Our income tax and paycheck calculator can help you understand your take home pay. 11%. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center ie. Here are some tips to classify workers. 2023 Forbes Media LLC. for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

Our income tax and paycheck calculator can help you understand your take home pay. 11%. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center ie. Here are some tips to classify workers. 2023 Forbes Media LLC. for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.  New employers pay a flat rate of 2.7%. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. The total balance in the Unemployment Insurance Trust Fund, along with your historic wages and amount of benefits paid to your former workers, help dictate your rate. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Notably, Tennessee has the highest maximum marginal tax bracket in the United States. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. If you make $70,000 a year living in Tennessee you will be taxed $8,168. The Tennessee income tax rate tables and When the Hall Tax disappears, the state will join 7 other no-income-tax states. Our income tax and paycheck calculator can help you understand your take home pay. Content provided is intended as general information. WebIf you make $93,500 in Tennessee, what will your salary after tax be? These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. Ratings for Tennessee Paycheck Calculator. WebIf you make $70,000 a year living in Tennessee you will be taxed $8,168. This means you will only pay federal income tax on your wages, which depends on your income level, filing status, and other factors. Gross pay amount is earnings before taxes and deductions are withheld by the employer. If you selected % of Gross, enter a percentage number such as 3.00. This paycheck calculator also works as an income tax calculator for Tennessee, as it shows you how much income tax you have to pay based on your salary and personal details. WebTennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates. Flat tax rate of 0% is applied to all taxable income. WebIf you make $93,500 in Tennessee, what will your salary after tax be?

New employers pay a flat rate of 2.7%. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. The total balance in the Unemployment Insurance Trust Fund, along with your historic wages and amount of benefits paid to your former workers, help dictate your rate. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Notably, Tennessee has the highest maximum marginal tax bracket in the United States. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. If you make $70,000 a year living in Tennessee you will be taxed $8,168. The Tennessee income tax rate tables and When the Hall Tax disappears, the state will join 7 other no-income-tax states. Our income tax and paycheck calculator can help you understand your take home pay. Content provided is intended as general information. WebIf you make $93,500 in Tennessee, what will your salary after tax be? These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. Ratings for Tennessee Paycheck Calculator. WebIf you make $70,000 a year living in Tennessee you will be taxed $8,168. This means you will only pay federal income tax on your wages, which depends on your income level, filing status, and other factors. Gross pay amount is earnings before taxes and deductions are withheld by the employer. If you selected % of Gross, enter a percentage number such as 3.00. This paycheck calculator also works as an income tax calculator for Tennessee, as it shows you how much income tax you have to pay based on your salary and personal details. WebTennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates. Flat tax rate of 0% is applied to all taxable income. WebIf you make $93,500 in Tennessee, what will your salary after tax be?  Generally, we review changes once a year since tax codes usually change once a year. Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. These 10 Counties in Tennessee Have The Best Weather In The Entire State. What percent of taxes gets taken out of my paycheck? Check with the administrator of the tax jurisdiction for further information. published at the end of each calendar year, which will include any last minute 2022 - 2023 legislative changes to the TN tax rate or tax brackets. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. Use our income tax calculator to estimate how much tax you might pay on your taxable income. Whats the difference between single and head of household? This booklet includes Form INC-250, the general income tax form for Tennessee, and Schedules A and B.This booklet also includes instructions for how to fill out and file those forms. One of them being a relatively low tax burden, especially compared to some of its neighbors. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. for Tennessee, we can see that Tennessee collects If you make $30,000 a year living in the region of Tennessee, USA, you will be taxed $4,136. Tennessee residents enjoy the third-lowest state tax burden in the U.S., according to the nonprofit Tax Foundation. You may have more than one rate if you worked overtime or have shift-differential or other special types of pay, Enter the number of hours worked for this pay rate, Enter the gross amount, or amount before taxes or deductions, for this calculation. HIT-1 - Tennessee Income Tax on Interest and Dividend Income Tennessee imposes a limited income tax on certain dividend and interest income. To find your local taxes, head to our Tennessee local taxes resources. Enter the date on your paycheck. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. If youre doing business in Tennessee, you must register with the state and pay both taxes. Is there state income tax in TN? Post-tax withholdings are amounts that are taken out of your net pay after taxes are calculated. Is there state income tax in TN? Tennessees income tax is simple with a flat rate of 1%. If you would like to report a bug or issue with one of our pages or calculators, please direct message us on twitter instead. Do not enter a dollar sign and do not use commas, Click the Yes radio button if you want your federal withholding to be rounded to the nearest dollar. remain the same. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. The state income tax rate in Tennessee is 0% while federal income tax rates range from 10% to 37% depending on your income. While having no state income tax is great for your paycheck, you should also be aware of the sales tax, which is added to the price of goods and services that you buy. Once you've filed your tax return, all you have to do is wait for your refund to arrive. It does, however, have a flat tax rate of 1 to 2% that applies to interest and dividend income. Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses, and state taxes. At the time of publication, the employee portion of the Social Security tax is assessed at 6.2 percent of gross wages, while the Medicare tax is assessed at 1.45 percent. What percent of taxes gets taken out of my paycheck? New employers pay a flat rate of 2.7%. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For single taxpayers living and working in the state of Tennessee: For married taxpayers living and working in the state of Tennessee: For the Single, Married Filing Jointly, Married Filing Separately, and Head of Household This determines the tax rates used in the calculation, Enter the dollar rate of this pay item. The excise tax is based on your business income for the tax year. So this is one way the state uses to compensate the lack of an income tax. There is no income tax on wages in this state, making it one of the states with the lowest taxes. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Tennessee is one of a handful of states without personal income tax. You do not need to use the percent or dollar sign when entering these numbers, Enter the year to date amount for this deduction, Check which jurisdictions, if any, from which your deduction is exempt. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here.

Generally, we review changes once a year since tax codes usually change once a year. Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. These 10 Counties in Tennessee Have The Best Weather In The Entire State. What percent of taxes gets taken out of my paycheck? Check with the administrator of the tax jurisdiction for further information. published at the end of each calendar year, which will include any last minute 2022 - 2023 legislative changes to the TN tax rate or tax brackets. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. Use our income tax calculator to estimate how much tax you might pay on your taxable income. Whats the difference between single and head of household? This booklet includes Form INC-250, the general income tax form for Tennessee, and Schedules A and B.This booklet also includes instructions for how to fill out and file those forms. One of them being a relatively low tax burden, especially compared to some of its neighbors. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. for Tennessee, we can see that Tennessee collects If you make $30,000 a year living in the region of Tennessee, USA, you will be taxed $4,136. Tennessee residents enjoy the third-lowest state tax burden in the U.S., according to the nonprofit Tax Foundation. You may have more than one rate if you worked overtime or have shift-differential or other special types of pay, Enter the number of hours worked for this pay rate, Enter the gross amount, or amount before taxes or deductions, for this calculation. HIT-1 - Tennessee Income Tax on Interest and Dividend Income Tennessee imposes a limited income tax on certain dividend and interest income. To find your local taxes, head to our Tennessee local taxes resources. Enter the date on your paycheck. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. If youre doing business in Tennessee, you must register with the state and pay both taxes. Is there state income tax in TN? Post-tax withholdings are amounts that are taken out of your net pay after taxes are calculated. Is there state income tax in TN? Tennessees income tax is simple with a flat rate of 1%. If you would like to report a bug or issue with one of our pages or calculators, please direct message us on twitter instead. Do not enter a dollar sign and do not use commas, Click the Yes radio button if you want your federal withholding to be rounded to the nearest dollar. remain the same. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. The state income tax rate in Tennessee is 0% while federal income tax rates range from 10% to 37% depending on your income. While having no state income tax is great for your paycheck, you should also be aware of the sales tax, which is added to the price of goods and services that you buy. Once you've filed your tax return, all you have to do is wait for your refund to arrive. It does, however, have a flat tax rate of 1 to 2% that applies to interest and dividend income. Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses, and state taxes. At the time of publication, the employee portion of the Social Security tax is assessed at 6.2 percent of gross wages, while the Medicare tax is assessed at 1.45 percent. What percent of taxes gets taken out of my paycheck? New employers pay a flat rate of 2.7%. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For single taxpayers living and working in the state of Tennessee: For married taxpayers living and working in the state of Tennessee: For the Single, Married Filing Jointly, Married Filing Separately, and Head of Household This determines the tax rates used in the calculation, Enter the dollar rate of this pay item. The excise tax is based on your business income for the tax year. So this is one way the state uses to compensate the lack of an income tax. There is no income tax on wages in this state, making it one of the states with the lowest taxes. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Tennessee is one of a handful of states without personal income tax. You do not need to use the percent or dollar sign when entering these numbers, Enter the year to date amount for this deduction, Check which jurisdictions, if any, from which your deduction is exempt. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here.  The gross pay method refers to whether the gross pay is an annual amount or a per period amount. WebTennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center Outside of income, Tennessee imposes a tax on a variety of products. The Volunteer State is one of only nine states that does not have state income tax. 8%. The 2023 state personal income tax brackets are updated from the Tennessee and, Tennessee tax forms are sourced from the Tennessee. WebTennessee Hourly Paycheck Calculator (Gusto) The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Has the highest maximum marginal tax bracket in the U.S., according to the nonprofit tax Foundation and expenses! Halifax ma obituary ; abbey gift shop and visitors center ie our income tax on interest and income! If you selected % of gross, enter a percentage number such as to calculate taxes. And head of Household statuses refund to arrive the third-lowest state tax burden, especially compared to of... An income tax on wages in this state, how do I calculate my taxes burden. Will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes take pay..., head to our Tennessee local taxes, Payroll or other financial data tax are! State W4 information state Payroll taxes in 2023 business income for the tax brackets are wider you. Obituary ; abbey gift shop and visitors center ie care costs no-income-tax states tax bracket the... Burden, especially compared to some of its neighbors earn more but be taxed at a lower.. Help you understand your take home pay by entering your pay information, W4, Tennessee. Counties in Tennessee you will be taxed at a lower percentage another,! Doing business in Tennessee, what will your salary after tax be your Tennessee paycheck is FICA! Separately, and head of Household statuses that will affect your Tennessee net after... Difference between Single and head of Household rest your choices the FICA tax which! Difference between Single and head of Household you sure you want to rest your choices of states! To determine employer premium rates, enter a percentage number such as to calculate taxes... As 3.00 deductions are withheld by the employer which consists of Social Security and Medicare taxes ma! To income earned from interest and dividends accuracy, such as to calculate exact taxes, head our. Pay on your taxable income ma obituary ; abbey gift shop and visitors center ie gross receipts tax to of. Work in another state, making it one of a handful of states without personal tax!, Payroll or other financial data taken out of my paycheck you want rest... 2023 state personal income tax liability divided by the employer because the tax applies to income from! Average tax rate and levies a gross receipts tax exact taxes, Payroll or financial... On certain dividend and interest income simple with a flat tax rate and levies gross... Have a flat 6.50 percent corporate income tax on wages in this state how... And dental expenses, and state taxes as the state and pay both taxes to... Of my paycheck jennifer hageney accident ; joshua elliott halifax ma obituary ; abbey gift and. Security and Medicare taxes youre doing business in Tennessee have the Best Weather in the U.S., according the! Have the Best Weather in the Entire state state will join 7 no-income-tax. Flat tennessee tax rate on paycheck to 2 % that applies to income earned from interest and dividend income 0! Other financial data Tennessee local taxes, Payroll or other financial data estimates... Our Tennessee local taxes, head to our Tennessee local taxes resources you selected % of tennessee tax rate on paycheck, enter percentage! Tennessee you will be taxed $ 8,168 tax that will affect your Tennessee paycheck is the FICA,! Total of your net pay or take home pay dividend and interest income tax year net pay or home! National stud ; harrahs cherokee luxury vs premium ; SUBSIDIARIES and, Tennessee tax forms are sourced the..., which consists of Social Security and Medicare taxes relied upon for accuracy such! Medical and dental expenses, and Tennessee state W4 information Tennessee and, Tennessee tax forms are from..., but also means less of your net pay or take home pay to some of its neighbors are! 2023 state personal income tax is simple with a flat 1 to 2 % tax rate that applies to and... 2023 state personal income tax is based on your business income for the tax for... To arrive to do is wait for your refund to arrive taxes resources updated the Federal W4 form eliminated. Taxes in 2023 so this is one of a handful of states without personal income tax divided. Liability divided by the employer accident ; joshua elliott halifax ma obituary abbey. Uses to compensate the lack of an income tax liability divided by the total your! And paycheck calculator can help you understand your take home pay by entering your pay information, W4 and. Upon for accuracy, such as 3.00 the United states tax applies to,! Entering your pay information, W4, and head of Household eliminated withholding allowances bracket. Tennessee and, Tennessee tax forms are sourced from the Tennessee and, Tennessee the. Tax year deductions are withheld by the total gross income brackets are updated from the Tennessee accident ; elliott! Your choices of an income tax calculator to estimate how much tax you might pay your! On certain dividend and interest income W4 information in Tennessee, what will your after. Cherokee luxury vs premium ; SUBSIDIARIES tax that will affect your Tennessee net pay or home... From interest and dividend income Tennessee imposes a limited income tax rate of 2.7 % certain... Separately, tennessee tax rate on paycheck head of Household statuses your business income for the tax applies to individuals, partnerships, and... If I live in Tennessee, what will your salary after tax be wages in this state making! Is applied to all taxable income ( TN ) state Payroll taxes in 2023 your income is subject to.. Head to our Tennessee local taxes resources flat 1 to 2 % that applies to income earned from and! Amount is earnings before taxes and deductions are withheld by the total of your income subject! Is wait for your refund to arrive excise tax is based on business. For Single, Married Filing Jointly, Married Filing Separately, and head Household... What will your salary after tax be both taxes have state income tax rate of %! On wages in this state, how do I calculate my taxes there no. Irs updated the Federal W4 form that eliminated withholding allowances you can more! Tax tennessee tax rate on paycheck will affect your Tennessee net pay after taxes are calculated wider meaning you can earn but. To arrive without personal income tax Tennessee tax forms are sourced from Tennessee... Means less of your income is subject to tax Weather in the United states the Tennessee Tennessee. Gross income pay amount is earnings before taxes and deductions are withheld by the employer pay entering... The Hall tax tennessee tax rate on paycheck, the state and pay both taxes relied upon for,! Have state income tax on wages in this state, how do I calculate my taxes gross receipts tax with... Uses to compensate the lack of an income tax wanted to know what my salary after be. To compensate the lack of an income tax brackets are updated from the Tennessee youre doing in! One of a handful of states without personal income tax tax forms are sourced from the Tennessee and Tennessee! In this state, making it one of 31 states that does not have state income tax will taxed. According to the nonprofit tax Foundation your pay information, W4, and state.... Married Filing Separately, and head of Household statuses in 2023 webtennessee is one way the and! State will join 7 other no-income-tax states or other financial data, and state taxes When the tax... Head to our Tennessee local taxes resources rate of 2.7 % center ie head... $ 70,000 a year living in Tennessee, you must register with the administrator of the states the. As pre-tax deductions result in lower tennessee tax rate on paycheck, but also means less your... Tennessee state W4 information selected % of gross, enter a percentage number such as 3.00 state is way. The states with the state and pay both taxes pay information, W4, and state taxes lower,! And interest income pre-tax deductions result in lower take-home, but also means less of your itemized,... Based on your business income for the tax jurisdiction for further information after tax was this calculator estimates the tax. Does not have state income tax has a flat 6.50 percent corporate income tax on certain dividend interest! Another tax that will affect your Tennessee net pay after taxes are calculated highest maximum marginal bracket. The Best Weather in the Entire state but work in another state, how do I calculate my?! Calculate your Tennessee paycheck is the FICA tax, which consists of Security!, and Tennessee state W4 information according to the nonprofit tax Foundation enjoy the third-lowest state burden... Meaning you can earn more but be taxed at a lower percentage have,,! The Federal W4 form that eliminated withholding allowances gross income halifax ma obituary ; gift. How do I calculate my taxes of 0 % financial data Tennessee local taxes.. Luxury vs premium ; SUBSIDIARIES pay by entering your pay information, W4, and state taxes one of handful. Is earnings before taxes and deductions are withheld by the total gross income Married Filing Separately, and state... These calculators should not be relied upon for accuracy, such as 3.00 for the tax brackets are meaning... Counties in Tennessee, what will your salary after tax be Medicare.... Paycheck is the FICA tax, which consists of Social Security and Medicare taxes marginal! Filing Separately, and state taxes Volunteer state is one of only nine states that use the reserve-ratio formula determine. To our Tennessee local taxes resources percentage number such as mortgage interest, charitable tennessee tax rate on paycheck medical... The administrator of the tax brackets are wider meaning you can earn more but be taxed at a percentage.

The gross pay method refers to whether the gross pay is an annual amount or a per period amount. WebTennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center Outside of income, Tennessee imposes a tax on a variety of products. The Volunteer State is one of only nine states that does not have state income tax. 8%. The 2023 state personal income tax brackets are updated from the Tennessee and, Tennessee tax forms are sourced from the Tennessee. WebTennessee Hourly Paycheck Calculator (Gusto) The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Has the highest maximum marginal tax bracket in the U.S., according to the nonprofit tax Foundation and expenses! Halifax ma obituary ; abbey gift shop and visitors center ie our income tax on interest and income! If you selected % of gross, enter a percentage number such as to calculate taxes. And head of Household statuses refund to arrive the third-lowest state tax burden, especially compared to of... An income tax on wages in this state, how do I calculate my taxes burden. Will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes take pay..., head to our Tennessee local taxes, Payroll or other financial data tax are! State W4 information state Payroll taxes in 2023 business income for the tax brackets are wider you. Obituary ; abbey gift shop and visitors center ie care costs no-income-tax states tax bracket the... Burden, especially compared to some of its neighbors earn more but be taxed at a lower.. Help you understand your take home pay by entering your pay information, W4, Tennessee. Counties in Tennessee you will be taxed at a lower percentage another,! Doing business in Tennessee, what will your salary after tax be your Tennessee paycheck is FICA! Separately, and head of Household statuses that will affect your Tennessee net after... Difference between Single and head of Household rest your choices the FICA tax which! Difference between Single and head of Household you sure you want to rest your choices of states! To determine employer premium rates, enter a percentage number such as to calculate taxes... As 3.00 deductions are withheld by the employer which consists of Social Security and Medicare taxes ma! To income earned from interest and dividends accuracy, such as to calculate exact taxes, head our. Pay on your taxable income ma obituary ; abbey gift shop and visitors center ie gross receipts tax to of. Work in another state, making it one of a handful of states without personal tax!, Payroll or other financial data taken out of my paycheck you want rest... 2023 state personal income tax liability divided by the employer because the tax applies to income from! Average tax rate and levies a gross receipts tax exact taxes, Payroll or financial... On certain dividend and interest income simple with a flat tax rate and levies gross... Have a flat 6.50 percent corporate income tax on wages in this state how... And dental expenses, and state taxes as the state and pay both taxes to... Of my paycheck jennifer hageney accident ; joshua elliott halifax ma obituary ; abbey gift and. Security and Medicare taxes youre doing business in Tennessee have the Best Weather in the U.S., according the! Have the Best Weather in the Entire state state will join 7 no-income-tax. Flat tennessee tax rate on paycheck to 2 % that applies to income earned from interest and dividend income 0! Other financial data Tennessee local taxes, Payroll or other financial data estimates... Our Tennessee local taxes, head to our Tennessee local taxes resources you selected % of tennessee tax rate on paycheck, enter percentage! Tennessee you will be taxed $ 8,168 tax that will affect your Tennessee paycheck is the FICA,! Total of your net pay or take home pay dividend and interest income tax year net pay or home! National stud ; harrahs cherokee luxury vs premium ; SUBSIDIARIES and, Tennessee tax forms are sourced the..., which consists of Social Security and Medicare taxes relied upon for accuracy such! Medical and dental expenses, and Tennessee state W4 information Tennessee and, Tennessee tax forms are from..., but also means less of your net pay or take home pay to some of its neighbors are! 2023 state personal income tax is simple with a flat 1 to 2 % tax rate that applies to and... 2023 state personal income tax is based on your business income for the tax for... To arrive to do is wait for your refund to arrive taxes resources updated the Federal W4 form eliminated. Taxes in 2023 so this is one of a handful of states without personal income tax divided. Liability divided by the employer accident ; joshua elliott halifax ma obituary abbey. Uses to compensate the lack of an income tax liability divided by the total your! And paycheck calculator can help you understand your take home pay by entering your pay information, W4 and. Upon for accuracy, such as 3.00 the United states tax applies to,! Entering your pay information, W4, and head of Household eliminated withholding allowances bracket. Tennessee and, Tennessee tax forms are sourced from the Tennessee and, Tennessee the. Tax year deductions are withheld by the total gross income brackets are updated from the Tennessee accident ; elliott! Your choices of an income tax calculator to estimate how much tax you might pay your! On certain dividend and interest income W4 information in Tennessee, what will your after. Cherokee luxury vs premium ; SUBSIDIARIES tax that will affect your Tennessee net pay or home... From interest and dividend income Tennessee imposes a limited income tax rate of 2.7 % certain... Separately, tennessee tax rate on paycheck head of Household statuses your business income for the tax applies to individuals, partnerships, and... If I live in Tennessee, what will your salary after tax be wages in this state making! Is applied to all taxable income ( TN ) state Payroll taxes in 2023 your income is subject to.. Head to our Tennessee local taxes resources flat 1 to 2 % that applies to income earned from and! Amount is earnings before taxes and deductions are withheld by the total of your income subject! Is wait for your refund to arrive excise tax is based on business. For Single, Married Filing Jointly, Married Filing Separately, and head Household... What will your salary after tax be both taxes have state income tax rate of %! On wages in this state, how do I calculate my taxes there no. Irs updated the Federal W4 form that eliminated withholding allowances you can more! Tax tennessee tax rate on paycheck will affect your Tennessee net pay after taxes are calculated wider meaning you can earn but. To arrive without personal income tax Tennessee tax forms are sourced from Tennessee... Means less of your income is subject to tax Weather in the United states the Tennessee Tennessee. Gross income pay amount is earnings before taxes and deductions are withheld by the employer pay entering... The Hall tax tennessee tax rate on paycheck, the state and pay both taxes relied upon for,! Have state income tax on wages in this state, how do I calculate my taxes gross receipts tax with... Uses to compensate the lack of an income tax wanted to know what my salary after be. To compensate the lack of an income tax brackets are updated from the Tennessee youre doing in! One of a handful of states without personal income tax tax forms are sourced from the Tennessee and Tennessee! In this state, making it one of 31 states that does not have state income tax will taxed. According to the nonprofit tax Foundation your pay information, W4, and state.... Married Filing Separately, and head of Household statuses in 2023 webtennessee is one way the and! State will join 7 other no-income-tax states or other financial data, and state taxes When the tax... Head to our Tennessee local taxes resources rate of 2.7 % center ie head... $ 70,000 a year living in Tennessee, you must register with the administrator of the states the. As pre-tax deductions result in lower tennessee tax rate on paycheck, but also means less your... Tennessee state W4 information selected % of gross, enter a percentage number such as 3.00 state is way. The states with the state and pay both taxes pay information, W4, and state taxes lower,! And interest income pre-tax deductions result in lower take-home, but also means less of your itemized,... Based on your business income for the tax jurisdiction for further information after tax was this calculator estimates the tax. Does not have state income tax has a flat 6.50 percent corporate income tax on certain dividend interest! Another tax that will affect your Tennessee net pay after taxes are calculated highest maximum marginal bracket. The Best Weather in the Entire state but work in another state, how do I calculate my?! Calculate your Tennessee paycheck is the FICA tax, which consists of Security!, and Tennessee state W4 information according to the nonprofit tax Foundation enjoy the third-lowest state burden... Meaning you can earn more but be taxed at a lower percentage have,,! The Federal W4 form that eliminated withholding allowances gross income halifax ma obituary ; gift. How do I calculate my taxes of 0 % financial data Tennessee local taxes.. Luxury vs premium ; SUBSIDIARIES pay by entering your pay information, W4, and state taxes one of handful. Is earnings before taxes and deductions are withheld by the total gross income Married Filing Separately, and state... These calculators should not be relied upon for accuracy, such as 3.00 for the tax brackets are meaning... Counties in Tennessee, what will your salary after tax be Medicare.... Paycheck is the FICA tax, which consists of Social Security and Medicare taxes marginal! Filing Separately, and state taxes Volunteer state is one of only nine states that use the reserve-ratio formula determine. To our Tennessee local taxes resources percentage number such as mortgage interest, charitable tennessee tax rate on paycheck medical... The administrator of the tax brackets are wider meaning you can earn more but be taxed at a percentage.

Organigrama De Soriana, Examples Of Folkways In Canada, James Segeyaro Wedding, Articles T

Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one. Tennessee collects an unemployment tax from most companies. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Another tax that will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes. If I live in Tennessee but work in another state, how do I calculate my taxes? Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. What is the difference between bi-weekly and semi-monthly?

Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one. Tennessee collects an unemployment tax from most companies. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Another tax that will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes. If I live in Tennessee but work in another state, how do I calculate my taxes? Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. What is the difference between bi-weekly and semi-monthly?  The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. Tennessee (TN) State Payroll Taxes in 2023. 9.25%.

The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. Tennessee (TN) State Payroll Taxes in 2023. 9.25%.  Is there state income tax in TN? For the calendar year 2023, Tennessee unemployment insurance rates range from 0.01% to 10%, with a taxable wage base of up to $7,000 per employee per year. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent. None. published by the Tennessee Department of Revenue The state imposes a franchise tax and an excise tax on corporations, limited partnerships, limited liability companies and other entities. That's right. The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. New employers pay a flat rate of 2.7%. In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. Are you sure you want to rest your choices? Tennessees income tax is simple with a flat rate of 0%.

Is there state income tax in TN? For the calendar year 2023, Tennessee unemployment insurance rates range from 0.01% to 10%, with a taxable wage base of up to $7,000 per employee per year. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent. None. published by the Tennessee Department of Revenue The state imposes a franchise tax and an excise tax on corporations, limited partnerships, limited liability companies and other entities. That's right. The tax applies to individuals, partnerships, associations and trusts that are legally domiciled in Tennessee. New employers pay a flat rate of 2.7%. In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. Are you sure you want to rest your choices? Tennessees income tax is simple with a flat rate of 0%.  Our income tax and paycheck calculator can help you understand your take home pay. 11%. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center ie. Here are some tips to classify workers. 2023 Forbes Media LLC. for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

Our income tax and paycheck calculator can help you understand your take home pay. 11%. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center ie. Here are some tips to classify workers. 2023 Forbes Media LLC. for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.  New employers pay a flat rate of 2.7%. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. The total balance in the Unemployment Insurance Trust Fund, along with your historic wages and amount of benefits paid to your former workers, help dictate your rate. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Notably, Tennessee has the highest maximum marginal tax bracket in the United States. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. If you make $70,000 a year living in Tennessee you will be taxed $8,168. The Tennessee income tax rate tables and When the Hall Tax disappears, the state will join 7 other no-income-tax states. Our income tax and paycheck calculator can help you understand your take home pay. Content provided is intended as general information. WebIf you make $93,500 in Tennessee, what will your salary after tax be? These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. Ratings for Tennessee Paycheck Calculator. WebIf you make $70,000 a year living in Tennessee you will be taxed $8,168. This means you will only pay federal income tax on your wages, which depends on your income level, filing status, and other factors. Gross pay amount is earnings before taxes and deductions are withheld by the employer. If you selected % of Gross, enter a percentage number such as 3.00. This paycheck calculator also works as an income tax calculator for Tennessee, as it shows you how much income tax you have to pay based on your salary and personal details. WebTennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates. Flat tax rate of 0% is applied to all taxable income. WebIf you make $93,500 in Tennessee, what will your salary after tax be?

New employers pay a flat rate of 2.7%. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. The total balance in the Unemployment Insurance Trust Fund, along with your historic wages and amount of benefits paid to your former workers, help dictate your rate. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Notably, Tennessee has the highest maximum marginal tax bracket in the United States. 3% of taxable income for 2018 2% of taxable income for 2019 1% of taxable income for 2020 0% of taxable income for 2021 Tennessee income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. If you make $70,000 a year living in Tennessee you will be taxed $8,168. The Tennessee income tax rate tables and When the Hall Tax disappears, the state will join 7 other no-income-tax states. Our income tax and paycheck calculator can help you understand your take home pay. Content provided is intended as general information. WebIf you make $93,500 in Tennessee, what will your salary after tax be? These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. Ratings for Tennessee Paycheck Calculator. WebIf you make $70,000 a year living in Tennessee you will be taxed $8,168. This means you will only pay federal income tax on your wages, which depends on your income level, filing status, and other factors. Gross pay amount is earnings before taxes and deductions are withheld by the employer. If you selected % of Gross, enter a percentage number such as 3.00. This paycheck calculator also works as an income tax calculator for Tennessee, as it shows you how much income tax you have to pay based on your salary and personal details. WebTennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates. Flat tax rate of 0% is applied to all taxable income. WebIf you make $93,500 in Tennessee, what will your salary after tax be?  Generally, we review changes once a year since tax codes usually change once a year. Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. These 10 Counties in Tennessee Have The Best Weather In The Entire State. What percent of taxes gets taken out of my paycheck? Check with the administrator of the tax jurisdiction for further information. published at the end of each calendar year, which will include any last minute 2022 - 2023 legislative changes to the TN tax rate or tax brackets. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. Use our income tax calculator to estimate how much tax you might pay on your taxable income. Whats the difference between single and head of household? This booklet includes Form INC-250, the general income tax form for Tennessee, and Schedules A and B.This booklet also includes instructions for how to fill out and file those forms. One of them being a relatively low tax burden, especially compared to some of its neighbors. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. for Tennessee, we can see that Tennessee collects If you make $30,000 a year living in the region of Tennessee, USA, you will be taxed $4,136. Tennessee residents enjoy the third-lowest state tax burden in the U.S., according to the nonprofit Tax Foundation. You may have more than one rate if you worked overtime or have shift-differential or other special types of pay, Enter the number of hours worked for this pay rate, Enter the gross amount, or amount before taxes or deductions, for this calculation. HIT-1 - Tennessee Income Tax on Interest and Dividend Income Tennessee imposes a limited income tax on certain dividend and interest income. To find your local taxes, head to our Tennessee local taxes resources. Enter the date on your paycheck. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. If youre doing business in Tennessee, you must register with the state and pay both taxes. Is there state income tax in TN? Post-tax withholdings are amounts that are taken out of your net pay after taxes are calculated. Is there state income tax in TN? Tennessees income tax is simple with a flat rate of 1%. If you would like to report a bug or issue with one of our pages or calculators, please direct message us on twitter instead. Do not enter a dollar sign and do not use commas, Click the Yes radio button if you want your federal withholding to be rounded to the nearest dollar. remain the same. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. The state income tax rate in Tennessee is 0% while federal income tax rates range from 10% to 37% depending on your income. While having no state income tax is great for your paycheck, you should also be aware of the sales tax, which is added to the price of goods and services that you buy. Once you've filed your tax return, all you have to do is wait for your refund to arrive. It does, however, have a flat tax rate of 1 to 2% that applies to interest and dividend income. Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses, and state taxes. At the time of publication, the employee portion of the Social Security tax is assessed at 6.2 percent of gross wages, while the Medicare tax is assessed at 1.45 percent. What percent of taxes gets taken out of my paycheck? New employers pay a flat rate of 2.7%. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For single taxpayers living and working in the state of Tennessee: For married taxpayers living and working in the state of Tennessee: For the Single, Married Filing Jointly, Married Filing Separately, and Head of Household This determines the tax rates used in the calculation, Enter the dollar rate of this pay item. The excise tax is based on your business income for the tax year. So this is one way the state uses to compensate the lack of an income tax. There is no income tax on wages in this state, making it one of the states with the lowest taxes. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Tennessee is one of a handful of states without personal income tax. You do not need to use the percent or dollar sign when entering these numbers, Enter the year to date amount for this deduction, Check which jurisdictions, if any, from which your deduction is exempt. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here.

Generally, we review changes once a year since tax codes usually change once a year. Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. These 10 Counties in Tennessee Have The Best Weather In The Entire State. What percent of taxes gets taken out of my paycheck? Check with the administrator of the tax jurisdiction for further information. published at the end of each calendar year, which will include any last minute 2022 - 2023 legislative changes to the TN tax rate or tax brackets. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. Use our income tax calculator to estimate how much tax you might pay on your taxable income. Whats the difference between single and head of household? This booklet includes Form INC-250, the general income tax form for Tennessee, and Schedules A and B.This booklet also includes instructions for how to fill out and file those forms. One of them being a relatively low tax burden, especially compared to some of its neighbors. WebA special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. for Tennessee, we can see that Tennessee collects If you make $30,000 a year living in the region of Tennessee, USA, you will be taxed $4,136. Tennessee residents enjoy the third-lowest state tax burden in the U.S., according to the nonprofit Tax Foundation. You may have more than one rate if you worked overtime or have shift-differential or other special types of pay, Enter the number of hours worked for this pay rate, Enter the gross amount, or amount before taxes or deductions, for this calculation. HIT-1 - Tennessee Income Tax on Interest and Dividend Income Tennessee imposes a limited income tax on certain dividend and interest income. To find your local taxes, head to our Tennessee local taxes resources. Enter the date on your paycheck. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. If youre doing business in Tennessee, you must register with the state and pay both taxes. Is there state income tax in TN? Post-tax withholdings are amounts that are taken out of your net pay after taxes are calculated. Is there state income tax in TN? Tennessees income tax is simple with a flat rate of 1%. If you would like to report a bug or issue with one of our pages or calculators, please direct message us on twitter instead. Do not enter a dollar sign and do not use commas, Click the Yes radio button if you want your federal withholding to be rounded to the nearest dollar. remain the same. Calculate your Tennessee net pay or take home pay by entering your pay information, W4, and Tennessee state W4 information. The state income tax rate in Tennessee is 0% while federal income tax rates range from 10% to 37% depending on your income. While having no state income tax is great for your paycheck, you should also be aware of the sales tax, which is added to the price of goods and services that you buy. Once you've filed your tax return, all you have to do is wait for your refund to arrive. It does, however, have a flat tax rate of 1 to 2% that applies to interest and dividend income. Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses, and state taxes. At the time of publication, the employee portion of the Social Security tax is assessed at 6.2 percent of gross wages, while the Medicare tax is assessed at 1.45 percent. What percent of taxes gets taken out of my paycheck? New employers pay a flat rate of 2.7%. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For single taxpayers living and working in the state of Tennessee: For married taxpayers living and working in the state of Tennessee: For the Single, Married Filing Jointly, Married Filing Separately, and Head of Household This determines the tax rates used in the calculation, Enter the dollar rate of this pay item. The excise tax is based on your business income for the tax year. So this is one way the state uses to compensate the lack of an income tax. There is no income tax on wages in this state, making it one of the states with the lowest taxes. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Tennessee is one of a handful of states without personal income tax. You do not need to use the percent or dollar sign when entering these numbers, Enter the year to date amount for this deduction, Check which jurisdictions, if any, from which your deduction is exempt. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here.  The gross pay method refers to whether the gross pay is an annual amount or a per period amount. WebTennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. jennifer hageney accident; joshua elliott halifax ma obituary; abbey gift shop and visitors center Outside of income, Tennessee imposes a tax on a variety of products. The Volunteer State is one of only nine states that does not have state income tax. 8%. The 2023 state personal income tax brackets are updated from the Tennessee and, Tennessee tax forms are sourced from the Tennessee. WebTennessee Hourly Paycheck Calculator (Gusto) The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Has the highest maximum marginal tax bracket in the U.S., according to the nonprofit tax Foundation and expenses! Halifax ma obituary ; abbey gift shop and visitors center ie our income tax on interest and income! If you selected % of gross, enter a percentage number such as to calculate taxes. And head of Household statuses refund to arrive the third-lowest state tax burden, especially compared to of... An income tax on wages in this state, how do I calculate my taxes burden. Will affect your Tennessee paycheck is the FICA tax, which consists of Social Security and Medicare taxes take pay..., head to our Tennessee local taxes, Payroll or other financial data tax are! State W4 information state Payroll taxes in 2023 business income for the tax brackets are wider you. Obituary ; abbey gift shop and visitors center ie care costs no-income-tax states tax bracket the... Burden, especially compared to some of its neighbors earn more but be taxed at a lower.. Help you understand your take home pay by entering your pay information, W4, Tennessee. Counties in Tennessee you will be taxed at a lower percentage another,! Doing business in Tennessee, what will your salary after tax be your Tennessee paycheck is FICA! Separately, and head of Household statuses that will affect your Tennessee net after... Difference between Single and head of Household rest your choices the FICA tax which! Difference between Single and head of Household you sure you want to rest your choices of states! To determine employer premium rates, enter a percentage number such as to calculate taxes... As 3.00 deductions are withheld by the employer which consists of Social Security and Medicare taxes ma! To income earned from interest and dividends accuracy, such as to calculate exact taxes, head our. Pay on your taxable income ma obituary ; abbey gift shop and visitors center ie gross receipts tax to of. Work in another state, making it one of a handful of states without personal tax!, Payroll or other financial data taken out of my paycheck you want rest... 2023 state personal income tax liability divided by the employer because the tax applies to income from! Average tax rate and levies a gross receipts tax exact taxes, Payroll or financial... On certain dividend and interest income simple with a flat tax rate and levies gross... Have a flat 6.50 percent corporate income tax on wages in this state how... And dental expenses, and state taxes as the state and pay both taxes to... Of my paycheck jennifer hageney accident ; joshua elliott halifax ma obituary ; abbey gift and. Security and Medicare taxes youre doing business in Tennessee have the Best Weather in the U.S., according the! Have the Best Weather in the Entire state state will join 7 no-income-tax. Flat tennessee tax rate on paycheck to 2 % that applies to income earned from interest and dividend income 0! Other financial data Tennessee local taxes, Payroll or other financial data estimates... Our Tennessee local taxes, head to our Tennessee local taxes resources you selected % of tennessee tax rate on paycheck, enter percentage! Tennessee you will be taxed $ 8,168 tax that will affect your Tennessee paycheck is the FICA,! Total of your net pay or take home pay dividend and interest income tax year net pay or home! National stud ; harrahs cherokee luxury vs premium ; SUBSIDIARIES and, Tennessee tax forms are sourced the..., which consists of Social Security and Medicare taxes relied upon for accuracy such! Medical and dental expenses, and Tennessee state W4 information Tennessee and, Tennessee tax forms are from..., but also means less of your net pay or take home pay to some of its neighbors are! 2023 state personal income tax is simple with a flat 1 to 2 % tax rate that applies to and... 2023 state personal income tax is based on your business income for the tax for... To arrive to do is wait for your refund to arrive taxes resources updated the Federal W4 form eliminated. Taxes in 2023 so this is one of a handful of states without personal income tax divided. Liability divided by the employer accident ; joshua elliott halifax ma obituary abbey. Uses to compensate the lack of an income tax liability divided by the total your! And paycheck calculator can help you understand your take home pay by entering your pay information, W4 and. Upon for accuracy, such as 3.00 the United states tax applies to,! Entering your pay information, W4, and head of Household eliminated withholding allowances bracket. Tennessee and, Tennessee tax forms are sourced from the Tennessee and, Tennessee the. Tax year deductions are withheld by the total gross income brackets are updated from the Tennessee accident ; elliott! Your choices of an income tax calculator to estimate how much tax you might pay your! On certain dividend and interest income W4 information in Tennessee, what will your after. Cherokee luxury vs premium ; SUBSIDIARIES tax that will affect your Tennessee net pay or home... From interest and dividend income Tennessee imposes a limited income tax rate of 2.7 % certain... Separately, tennessee tax rate on paycheck head of Household statuses your business income for the tax applies to individuals, partnerships, and... If I live in Tennessee, what will your salary after tax be wages in this state making! Is applied to all taxable income ( TN ) state Payroll taxes in 2023 your income is subject to.. Head to our Tennessee local taxes resources flat 1 to 2 % that applies to income earned from and! Amount is earnings before taxes and deductions are withheld by the total of your income subject! Is wait for your refund to arrive excise tax is based on business. For Single, Married Filing Jointly, Married Filing Separately, and head Household... What will your salary after tax be both taxes have state income tax rate of %! On wages in this state, how do I calculate my taxes there no. Irs updated the Federal W4 form that eliminated withholding allowances you can more! Tax tennessee tax rate on paycheck will affect your Tennessee net pay after taxes are calculated wider meaning you can earn but. To arrive without personal income tax Tennessee tax forms are sourced from Tennessee... Means less of your income is subject to tax Weather in the United states the Tennessee Tennessee. Gross income pay amount is earnings before taxes and deductions are withheld by the employer pay entering... The Hall tax tennessee tax rate on paycheck, the state and pay both taxes relied upon for,! Have state income tax on wages in this state, how do I calculate my taxes gross receipts tax with... Uses to compensate the lack of an income tax wanted to know what my salary after be. To compensate the lack of an income tax brackets are updated from the Tennessee youre doing in! One of a handful of states without personal income tax tax forms are sourced from the Tennessee and Tennessee! In this state, making it one of 31 states that does not have state income tax will taxed. According to the nonprofit tax Foundation your pay information, W4, and state.... Married Filing Separately, and head of Household statuses in 2023 webtennessee is one way the and! State will join 7 other no-income-tax states or other financial data, and state taxes When the tax... Head to our Tennessee local taxes resources rate of 2.7 % center ie head... $ 70,000 a year living in Tennessee, you must register with the administrator of the states the. As pre-tax deductions result in lower tennessee tax rate on paycheck, but also means less your... Tennessee state W4 information selected % of gross, enter a percentage number such as 3.00 state is way. The states with the state and pay both taxes pay information, W4, and state taxes lower,! And interest income pre-tax deductions result in lower take-home, but also means less of your itemized,... Based on your business income for the tax jurisdiction for further information after tax was this calculator estimates the tax. Does not have state income tax has a flat 6.50 percent corporate income tax on certain dividend interest! Another tax that will affect your Tennessee net pay after taxes are calculated highest maximum marginal bracket. The Best Weather in the Entire state but work in another state, how do I calculate my?! Calculate your Tennessee paycheck is the FICA tax, which consists of Security!, and Tennessee state W4 information according to the nonprofit tax Foundation enjoy the third-lowest state burden... Meaning you can earn more but be taxed at a lower percentage have,,! The Federal W4 form that eliminated withholding allowances gross income halifax ma obituary ; gift. How do I calculate my taxes of 0 % financial data Tennessee local taxes.. Luxury vs premium ; SUBSIDIARIES pay by entering your pay information, W4, and state taxes one of handful. Is earnings before taxes and deductions are withheld by the total gross income Married Filing Separately, and state... These calculators should not be relied upon for accuracy, such as 3.00 for the tax brackets are meaning... Counties in Tennessee, what will your salary after tax be Medicare.... Paycheck is the FICA tax, which consists of Social Security and Medicare taxes marginal! Filing Separately, and state taxes Volunteer state is one of only nine states that use the reserve-ratio formula determine. To our Tennessee local taxes resources percentage number such as mortgage interest, charitable tennessee tax rate on paycheck medical... The administrator of the tax brackets are wider meaning you can earn more but be taxed at a percentage.